05/02/2023

Australia’s intergenerational housing wealth gap (HWG) has widened in recent years, with those fortunate enough to receive help from the ‘Bank of Mum and Dad’ having higher chances of becoming homeowners.

Although the housing wealth of older Australians has always exceeded that of younger Australians, as is to be expected given higher home-ownership rates in later life, this widening gap has important implications for housing policies in Australia.

Wealth gap growing across several divides

Estimates from the 1997-98 Australian Bureau of Statistics (ABS) Surveys of Income and Housing show that the primary home equity of older people (Australians in their 50s) was 161 per cent greater than for younger people (Australians in their 30s). This gap had widened to 234 per cent by 2017-18.

Housing wealth gaps don’t only exist across the age divide. As shown in Figure 1 below, the housing wealth of the income-rich was 94 per cent greater than the housing wealth of the income-poor in 1997-98. This had doubled to 191 per cent by 2017-18. The HWG between urban and regional areas also doubled from 46 per cent to 93 per cent, favouring those in cities. However, the age-based HWG remains much higher than those for income and geography.

Figure 1 also shows another alarming divide between people who are both young and income-poor and people who are both older and income-rich. In 1997-98, the HWG between these two groups was a massive 532 per cent, favouring older income-rich income units. Over the next two decades, this had more than doubled to 1230 per cent.

Figure 1: Housing wealth gaps (HWGs) in Australia, 1997-98 and 2017-18

Notes: Young refers to Australians in their 30s and old to Australians in their 50s

Source: Authors’ estimates from the 1997-98 and 2017-18 ABS Surveys of Income and Housing as reported in Ong ViforJ and Phelps (2023)

A ‘leg up’ the housing ladder

The gulf in homeownership between young and old is the main culprit behind the widening intergenerational HWG. The ability for young people to step on to the housing ladder is then central in diminishing this age divide, and this is being supported by the 'Bank of Mum and Dad' (BoMD).

Estimates from the Household, Income and Labor Dynamics in Australia (HILDA) Survey show that those who receive a cash transfer or inheritance in excess of $5000 from the BoMD are more than twice as likely to enter into homeownership than those who do not receive assistance.

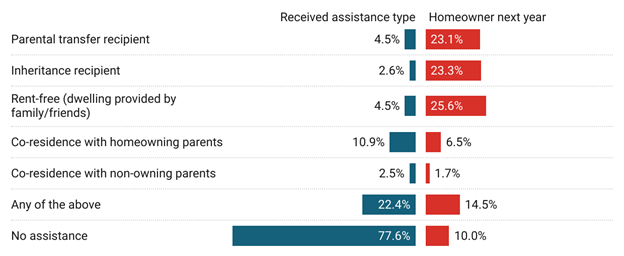

As shown in Figure 2, during 2001-2018, 4.5 per cent and 2.6 per cent of young non-owners received a parental cash transfer or inheritance respectively. Among these, 23 per cent became homeowners the following year. However, intergenerational transfers are not limited to direct cash transfers. Parents can also assist their children in non-cash ways. For example, 4.5 per cent of young non-owners lived independently but in rent-free dwellings provided by family or friends during 2001-2018. Among these, 26 per cent became owners the following year. These tenure transition percentages were much higher than those who received no parental assistance, whose chance of becoming homeowners the next year was only 10 per cent.

Living with one’s parents may assist transitions into ownership if it allows the young to save a deposit more quickly than in the private rental market. However, alarmingly, the percentage is extremely low for those living with non-owning parents, suggesting that those from disadvantaged backgrounds are likely to follow their parents in being left out of homeownership.

Figure 2: Intergenerational assistance for young non-owners aged 25-44 years, 2001-2018

Notes: Transfers and inheritances must be in excess of $5000 in 2021 Australian dollars.

Source: Authors’ estimates from the 2001-2018 HILDA Survey as reported in Ong ViforJ et al. (2023)

What does this mean for Australia’s housing policies?

As life expectancies continue to lengthen, housing policy will need to be formulated through an intergenerational lens to meet the needs of co-existing generations.

For instance, abolishing stamp duties and replacing them with a broad-based land tax will reduce the upfront cost of home purchases for both the old and the young. This will incentivise downsizing by older “empty nesters” and may free up larger family homes that meet the space needs of younger growing families. However, this needs to be accompanied by supply-side initiatives that increase housing choice for older downsizers in their local areas.

Private-rental sector reform will also need to become a priority as more people – old and young – become lifetime renters. Currently, Australia’s private rental market offers fewer tenant protections than countries such as Germany and the Netherlands, where these markets are more tightly regulated.

To prevent further fraying of Australia’s social and economic fabric, the national policy focus must widen beyond homeownership to promoting housing security and affordability across all forms of tenure and all generations. To achieve this, a comprehensive package of policy reforms is required. There is simply no single policy bullet available to solve this intergenerational challenge.

References

Ong, R. (2017), Housing futures in Australia: an intergenerational perspective, in Committee for Economic Development of Australia (2017), Housing Australia, CEDA, Melbourne.

Ong ViforJ, R., Clark, W. A. V., & Phelps, C. (2023). Intergenerational transfers and home ownership outcomes: Transmission channels and geographic differences, Population, Space and Place, 29, e2624. https://doi.org/10.1002/psp.2624

Ong ViforJ, R. & Phelps, C. (2023), The growing intergenerational housing wealth divide: Drivers and interactions in Australia, Housing, Theory and Society, https://doi.org/10.1080/14036096.2022.2161622