PROGRESS 2050: Toward a prosperous future for all Australians

18/07/2021

Efforts to reduce carbon emissions, projected reductions in Federal Government revenue, concern for living and health standards and the introduction of new vehicle technologies present a unique opportunity for tax reform.

New technologies, such as electric and fuel cell technology, will play a significant role in reducing CO2 emissions from motor vehicles, currently about 10 per cent of all emissions.

However, the transition to ‘electrified’ mobility in all its forms will also rapidly accelerate the long-term decline of Federal Government revenue from fuel excise.

The 2021 Intergenerational Report (IGR) highlights the growing issues of climate change and declining tax revenue. The introduction of a road-user charge to replace the inefficient taxes currently paid by motorists could help guarantee future tax revenue without hindering the shift to cleaner transportation.

The future of fuel excise

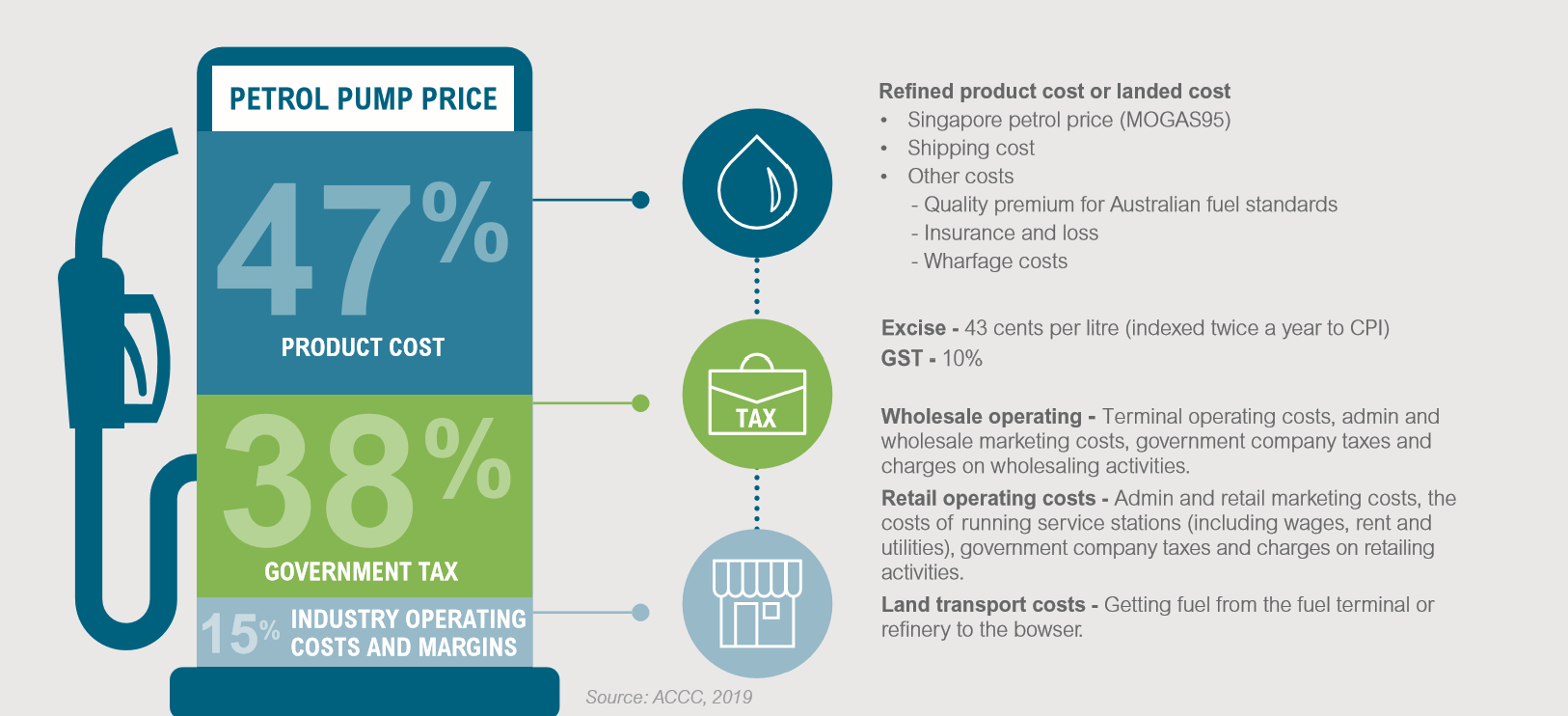

For every litre of fuel an Australian motorist pumps into their vehicle, $0.43 is paid to the Government as excise. In 2019-20, Australian Government general government (cash) receipts showed that fuel excise was $17.8 billion. The forward estimates through to 2023-24 project that figure to rise by about 12.3 per cent to $20 billion.

On the face of it, the excise will continue to increase as the number of vehicles on our roads continues to increase. However, the excise earned ‘per vehicle’ is in decline as engines become more efficient and non-petrol/diesel vehicles carve out a greater share of our market.

For example, in 2001, there were 12.1 million vehicles on our roads and fuel excise was $13 billion. In 2008, the number of vehicles had increased to 19.2 million and excise was $17.5 billion – a reduction of 12.4 per cent on the excise earned per vehicle. In 2021, the ABS reported 20 million registered vehicles while fuel excise is projected to remain at $17.5 billion.

It is challenging to project when the revenue curve begins to turn, but it is safe to assume that by the end of this decade, the fuel excise revenue required to maintain services including to develop and maintain our road and transport infrastructure will begin to decline relative to the number of vehicles.

This shift will be significant over the long term, and the revenue lost will need to be offset.

The case for road-user charging

To address this change, pursue a cleaner environment and healthier community, and deal with rapid technological change, governments should consider replacing the current taxes on Australian motorists with one road-user charge.

In addition to fuel excise, Australian drivers currently pay charges including sales tax, stamp duty, luxury taxes, licence fees and compulsory third-party insurance. Some discussions have also taken place regarding the potential for a congestion charge.

The FCAI raised this challenge in a discussion paper released in May this year entitled Road User Charging – A nationally consistent 21st century approach.

How would it work?

Depending on how such a charge is implemented, it could be designed so that most people would pay no more than they currently do – some might even pay less. Consideration can be given to the needs of regional and remote drivers compared with city drivers.

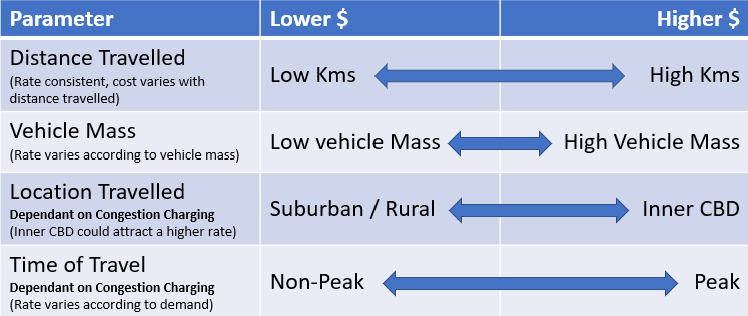

An efficient road-user charging scheme can address all vehicle users regardless of the vehicle they drive, how often it is driven and the purpose of travel. For example, it could be based on vehicle mass, distance travelled, time or place of travel or a combination of factors. This makes it a true user-pays approach.

The following table shows how an efficient road-user charging scheme could account for a range of variables:

This year, the Victorian and NSW governments have released plans to introduce a road-user charge for electric vehicles and plug-in hybrid vehicles in lieu of these vehicle owners contributing to fuel excise. South Australia is also considering this. The Tasmanian, ACT and NSW governments have introduced stamp duty and registration concessions for buyers of electric vehicles. In some cases, these announcements have been supported with continuing investment in infrastructure and fleets.

A Federally led approach would be ideal. However, at the very least, governments must implement this type of reform in a way that is consistent across borders.

The infrastructure investment, fee concessions and incentives being provided by State Governments can certainly encourage the continuing growth in the number of zero and low emission vehicles. These measures can offset these early steps by State Governments to introduce the road user charge to a relatively small proportion of the vehicles on Australian roads.

The real value of road user changing will be realised when it is applied across all vehicle technologies across all regions of the country. One charge replacing many outdated and clumsy taxes; one charge reducing complex and unwieldy government administration and bureaucracy; one charge delivering revenue certainty and delivering clarity for customers.

A measured and practical approach to a road user charging methodology may take some years and require courageous leadership. However, it is an opportunity for Australia to take the lead and set a framework for sound policy at a time when other countries are also considering this opportunity for reform.