Explore our Progress 2050 Goal Tracker

Widespread flooding across the country this year has served as just the latest reminder of Australia’s exposure to the effects of a changing climate.

The personal and economic costs of these extreme weather events are significant, with estimates that 10,000 homes and businesses were damaged or destroyed in the Mid North Coast floods alone.

As the newly released National Climate Risk Assessment emphasises, events like these are only expected to increase in frequency in coming decades. Widespread adoption of insurance is one way that Australians can protect themselves from the financial hardship that can follow in their wake.

While most Australian homes are insured, CEDA analysis of the latest Household Income and Labour Dynamics in Australia (HILDA) survey data reinforces a growing body of research that suggests Australians are not sufficiently protected from natural disasters.

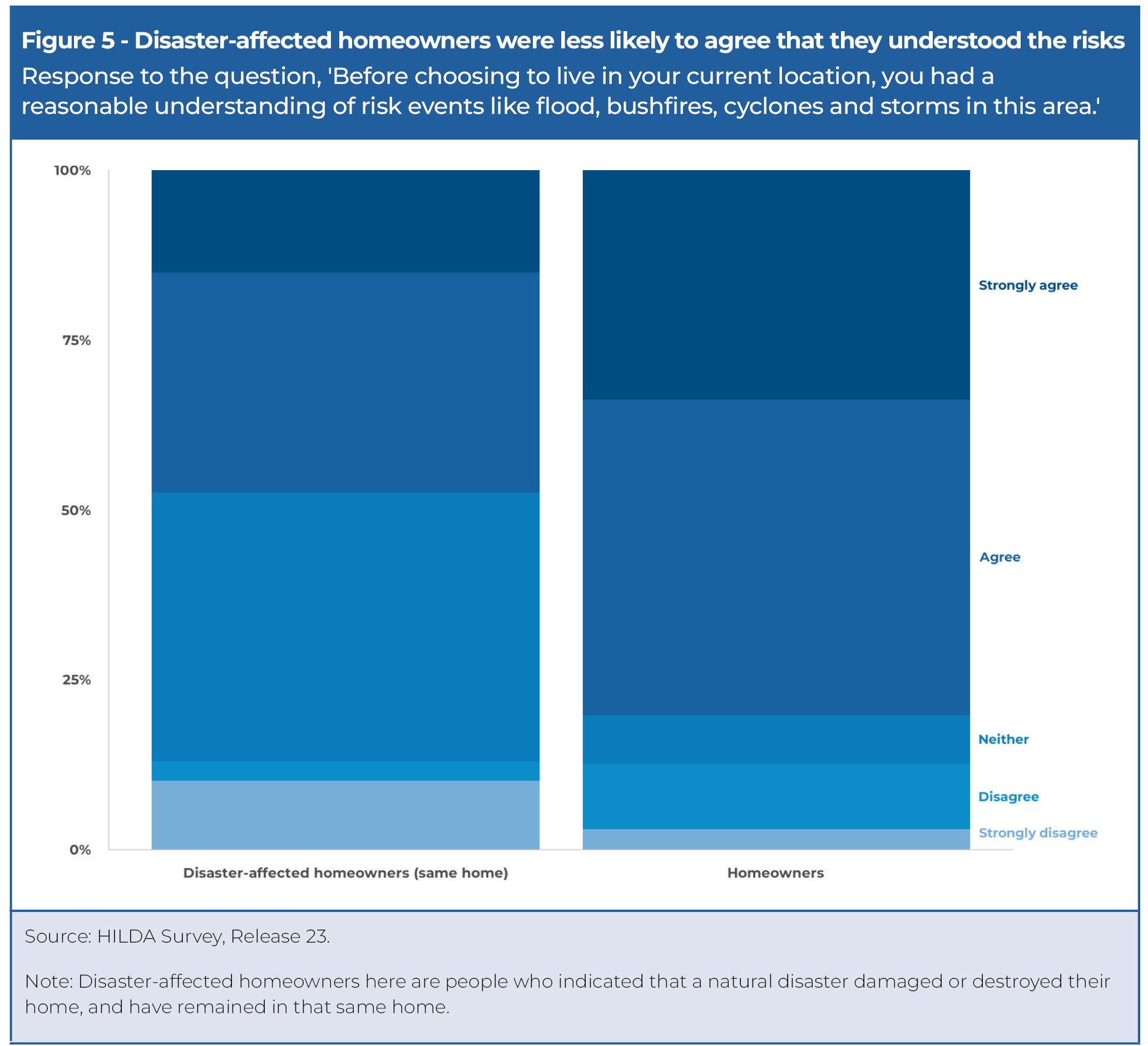

We found a striking disparity in homeowners’ risk awareness: While more than three-quarters believed they had a good understanding of their property’s risks when moving in, only half of those who had actually lived through a damaging weather event said the same, suggesting Australians might not be aware of the level of insurance cover they need.

We also found that fewer than one in four homeowners regularly review their level of home insurance to ensure it fully covers their property, increasing the risk of inadequate coverage in the event of a disaster.

These findings add to growing evidence that Australians are not receiving enough information to make informed decisions about the level of insurance they need to cover the risks to their homes.

Australians have high levels of basic home insurance

The latest available HILDA survey, taken in 2023, included a range of questions about Australians’ uptake of and perspectives towards property insurance for the first time.

The survey asked a nationally representative group of more than 17,000 Australians to indicate if their home was insured, if their policies covered flood damage and whether they had contents insurance. Survey-takers were also asked whether they thought their insurance would allow them to fully rebuild their home or replace all its contents if needed.

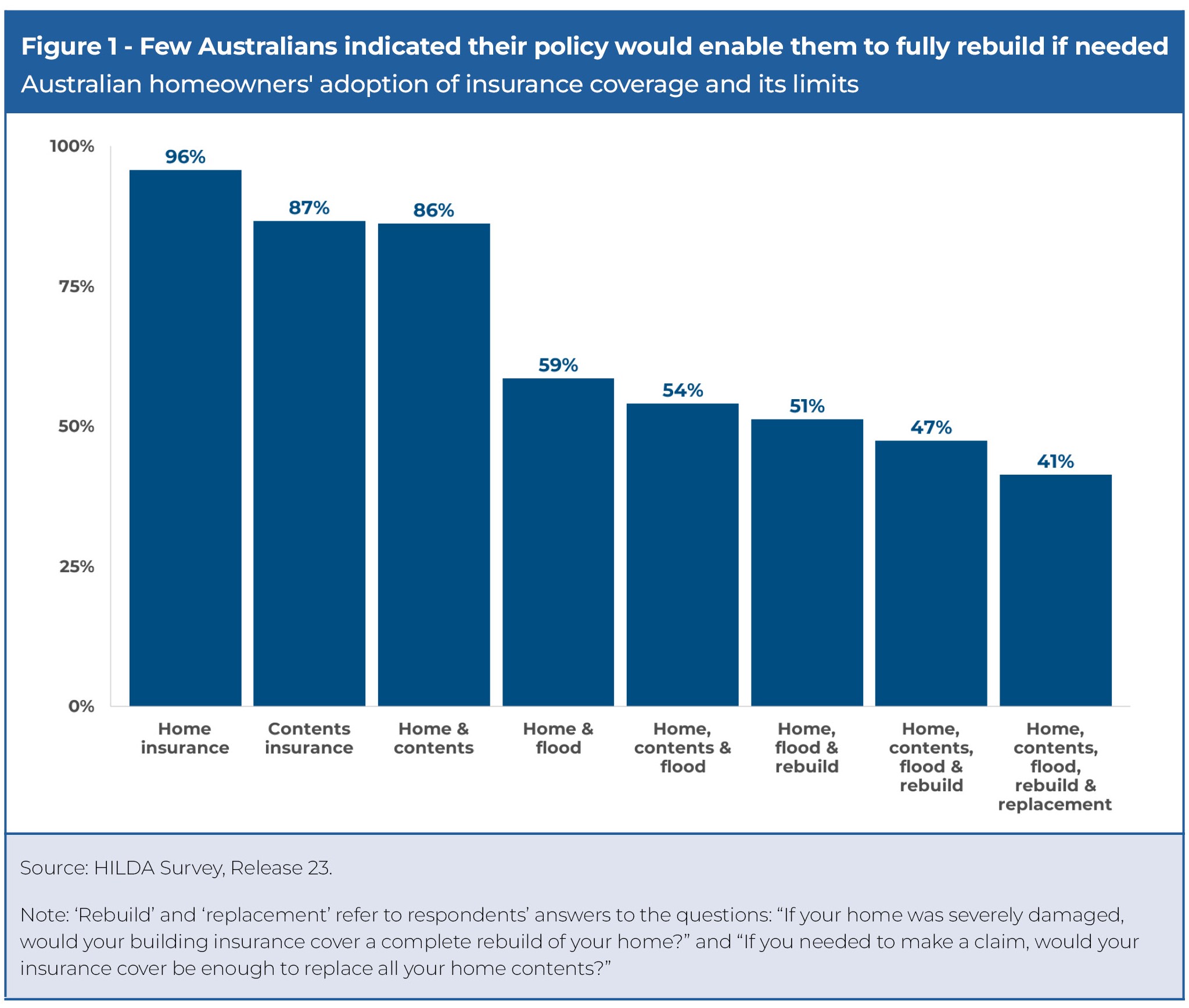

Overall levels of home insurance were very high among homeowners, at 96 per cent (Figure 1), likely due to bank requirements for mortgaged properties to have some level of insurance.

But only 59 per cent of homeowners indicated that their policies covered flood damage, while just 41 per cent said their policy would also cover a full rebuild of the home and replacement of all its contents.

Our analysis showed that this drop in coverage beyond simple home and contents packages occurred across all income levels, with no observable increase in the breadth of policy cover among higher-income homeowners.

Further, the 41 per cent of households who thought they were fully protected is almost certainly overstated due to the low proportion of homeowners who update their insurance coverage annually. More than three-quarters did not update their insurance cover in the last year to reflect the higher replacement costs that can come with increases in property values and changes to material and labour costs.

This is problematic because even insured homeowners can face a financial shortfall when making a claim if they don’t update their cover limits, leaving them unable to rebuild to previous standards or forcing them to take on additional debt.

The low rate of insurance review was also constant across income groups. Taken together, these results suggest that more should be done to encourage homeowners to review their policies regularly.

Storms on the horizon

These findings stand at odds with the growing need for protection against severe weather events like those seen throughout this year.

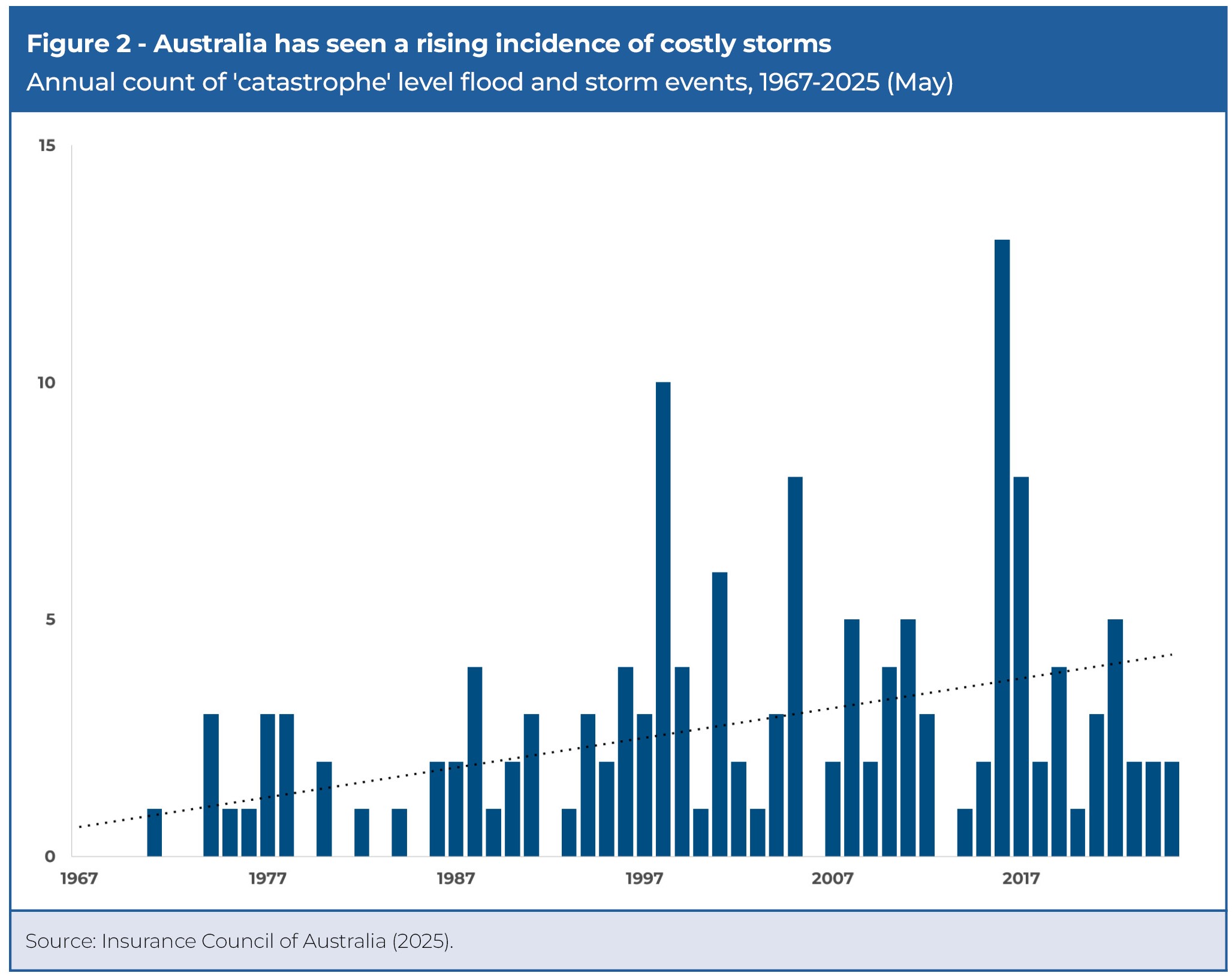

Indeed, extreme rainfall events have increased in intensity by as much as 10 per cent in some regions in recent decades. The frequency of major storms and flooding has also increased over the past 50 years (Figure 2).

Over the last 10 years, severe floods and storms have resulted in insured losses worth $18.9 billion in nominal terms. The total cost of these disasters, including uninsured losses, lost economic activity and health costs, would be much higher.

Increasing property values, the proximity of our cities to rivers and coastlines and rising populations have been key drivers of the vast and increasing cost attached to severe storms and floods.

Indeed, the Australian Government’s National Climate Risk Assessment found that around 8.2 per cent, or 751,000 residential buildings are currently located in areas with high risk of exposure to natural hazards.

When it comes to flooding, insurers estimate that around 1.2 million homes face at least some risk, while approximately 4.4 per cent (675,000) of homes are estimated to have at least a 1-to-5 per cent annual probability of flooding. These numbers are only expected to grow.

The magnitude of these events presents a growing risk to government budgets. In New South Wales alone, average annual disaster relief and recovery spending has increased tenfold, from $154 million in 2013-18 to $1.6 billion since 2019.

Beyond relief and recovery spending, the climate risk assessment projects that the national economic costs of disasters will exceed $40 billion per year by 2050.

The magnitude of these events presents a growing risk to government budgets. In New South Wales, average annual disaster relief and recovery spending has increased tenfold, from $154 million in 2013-18 to $1.6 billion since 2019.

The cost of insurance

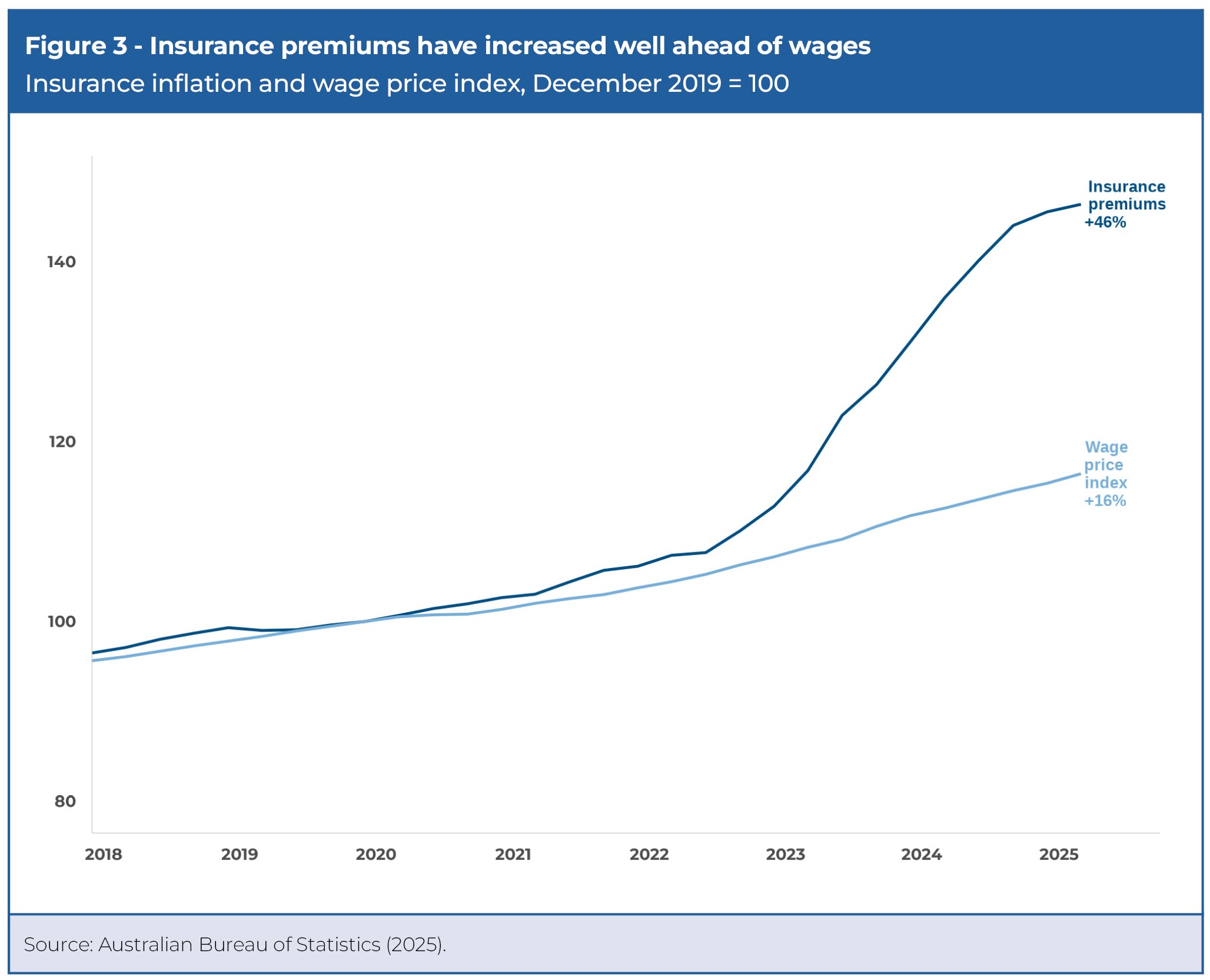

One barrier to more widespread adoption of insurance may be its rising cost.

Growth in insurance costs has outpaced that of wages in recent years, exacerbating the financial pressure for some households (Figure 3). This has been driven by higher reinsurance costs for insurers, rising property values, the increasing frequency and intensity of disasters, and increased material and labour costs in the construction sector.

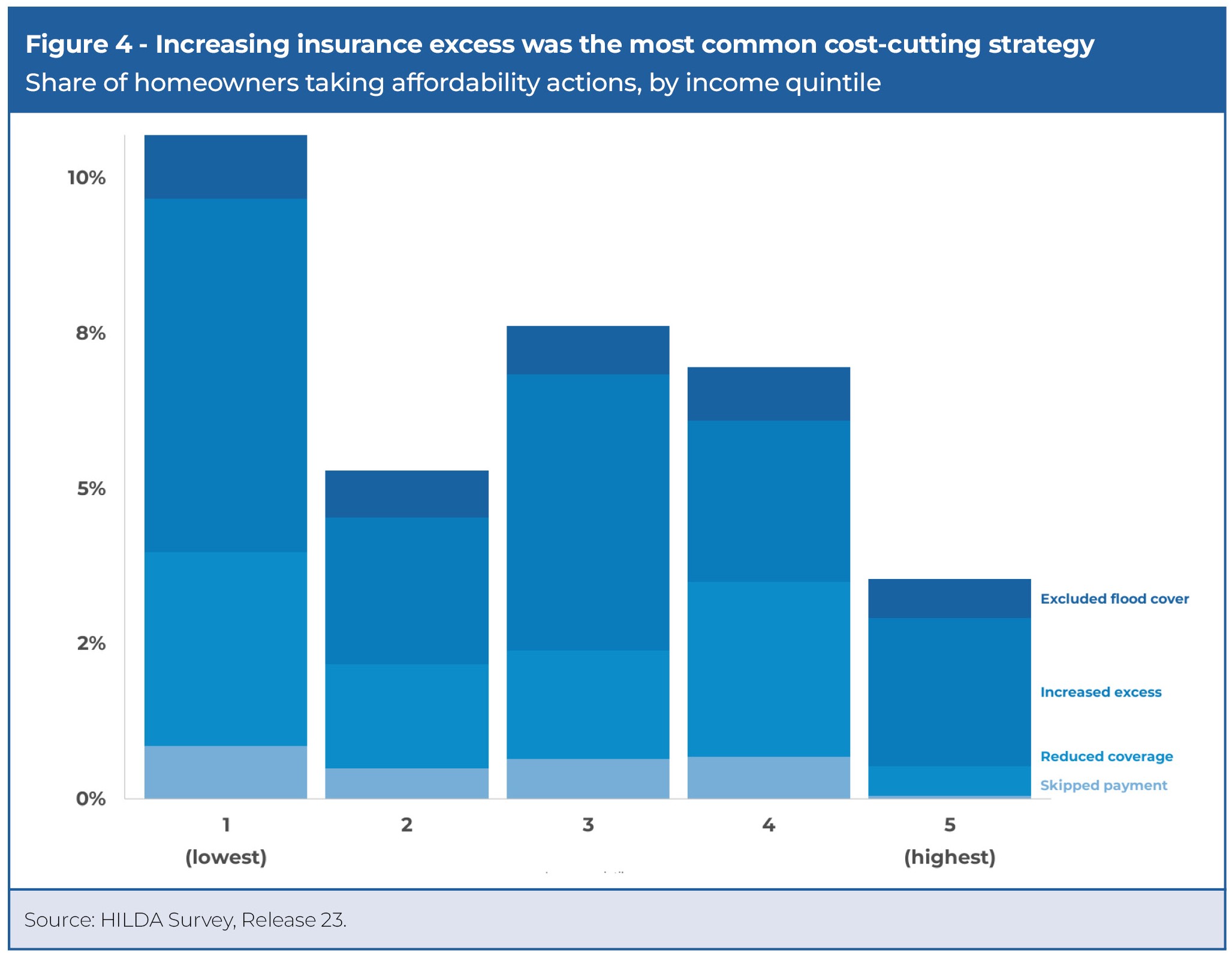

Despite these pressures, research indicates that for most Australians insurance remains affordable. Our analysis supports this view, as we found that fewer than six per cent of homeowners chose to take active steps to reduce the financial burden of insurance in the past year due to a shortage of money (Figure 4).

Of those who did, the most common steps were to either reduce their coverage or increase their excess. Households at the bottom 20 per cent of the income distribution showed the greatest tendency to reduce their insurance costs, a finding that mirrors other research showing insurance affordability pressures are most often felt by those least able to afford them.

As more data becomes available, these trends will be important to monitor. Although the proportion of people who needed to cut their insurance costs was low, any rise in this figure would be strong evidence of affordability pressures and increase the risk of broad underinsurance among homeowners.

Reduced coverage means property owners are on the hook for a greater share of replacement costs, while a higher excess increases the out-of-pocket expense that immediately follows an incident. Both factors – coupled with the low proportion of homeowners reviewing their coverage annually – can amplify the financial shock when things go wrong.

Flood cover is complex

While most households can generally access basic levels of insurance, protecting against flood risk presents a greater challenge.

Flood cover is a relatively new development in Australia, only becoming widely available since 2008. Prior to this, data and modelling limitations meant that pricing flood risk was viewed as “too hard” or “a very inexact and approximate exercise”.

Notwithstanding recent improvements in data availability and modelling techniques, offering flood cover can still be challenging for insurers. This is because floods can affect large geographic areas and properties simultaneously, meaning that providers can find it difficult to adequately diversify their risk and may in turn be reluctant to offer coverage.

When flood insurance is available to households, it is not uncommon for it to represent the largest component of an insurance premium. This cost pressure is often concentrated among households that are ‘affordability stressed’, for whom annual insurance costs exceed four weeks of gross household income. The average flood premium for these households is nearly 16 times higher than for non-stressed households.

Indeed, for very high-risk properties, the flood component of annual premiums can range between $7000 to as much as $30,000.

Understanding the risks

While the cost of insurance undoubtedly influences its uptake, just as important is how Australians understand the risk posed to their property.

More than three-quarters of homeowners said they had a good understanding of the risks posed to their property before moving in (Figure 5). But of people whose home had been damaged or destroyed by a weather-related event, only half agreed that they understood the risk they faced.

One troubling interpretation of this discrepancy is that people may not fully understand the risks to their property until it is too late. Indeed, research has shown that without first-hand experience of hazards, people can tend to overestimate how well they understand potential dangers.

So while many Australians may have felt they understood the existence of risk before moving in, there could be a mismatch between their perception of the dangers to their property and the actual risks they face.

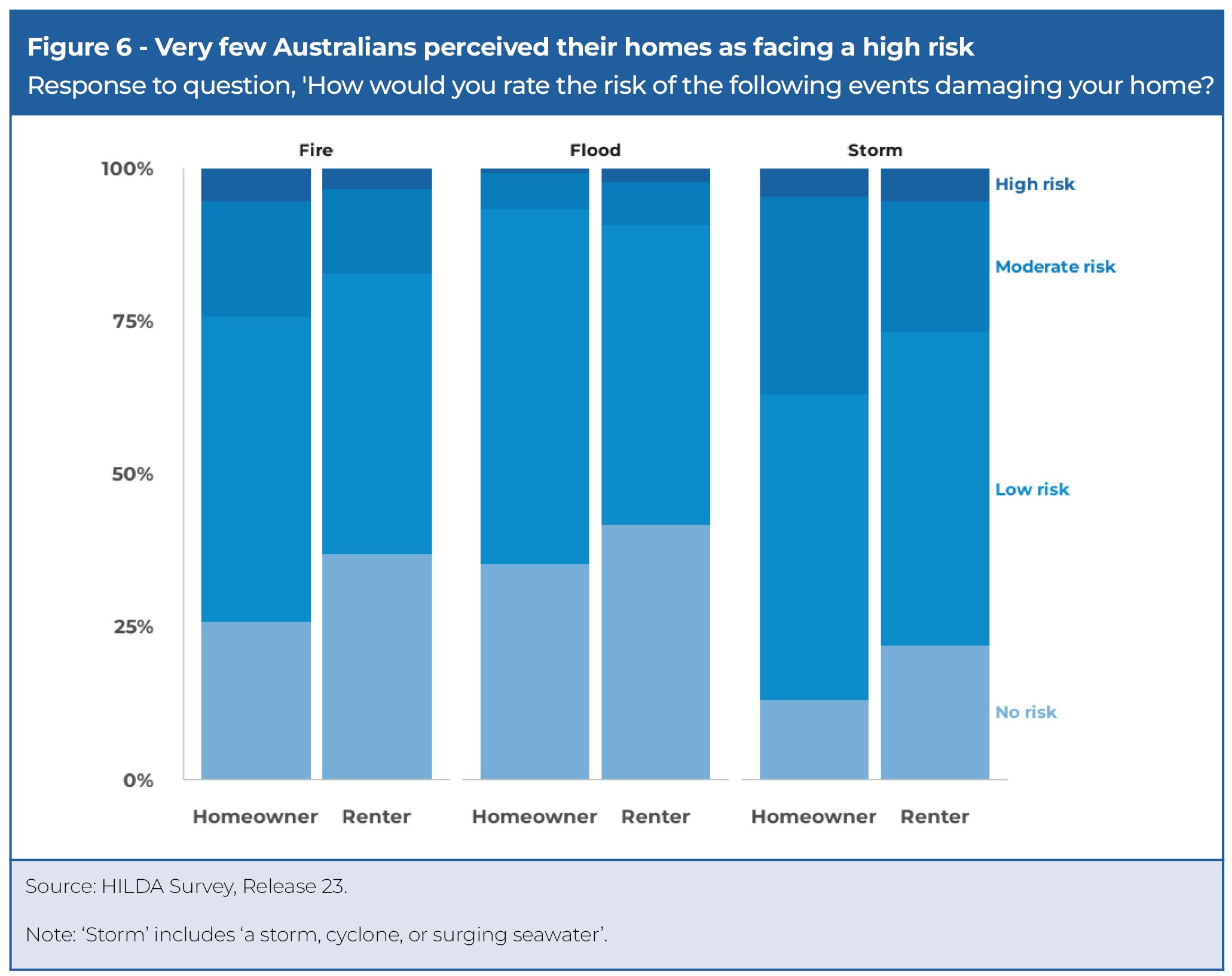

When evaluating the risk posed to their property from fire, flood or storm damage, around three-quarters of homeowners considered that their homes faced low or no risk (Figure 6). Just under five per cent saw a high risk from storms, while less than one per cent said they had a high risk of flood damage.

Any potential discrepancy between perception and reality is highly complex to evaluate. But the problem of accurately assessing risk is compounded by the lack of accessible information that would help households better understand the dangers to their property, particularly with respect to flooding.

Indeed, last year’s House of Representatives Inquiry into insurers’ responses to 2022 major floods found that “flood risk data is currently held by multiple parties in a complex ecosystem—and the stakeholders with the least access are households and small businesses".

Generally, local councils commission flood studies that can be accessed via online portals or made available on request. However, a survey undertaken in conjunction with the parliamentary inquiry found that 72 per cent of households indicated that they could not access their council’s flood risk information online or were unsure about it. Accessing this information can also involve paying fees.

Additionally, public flood studies have been found to lack consistent approaches and be of variable quality, in part due to capability and resourcing challenges. Small, regional councils, which have smaller revenue bases than those in metropolitan areas, have reported challenges covering study costs that can run into the millions. These challenges are expected to grow as more advanced modelling that incorporates different climate change scenarios becomes more prevalent.

Insurers utilise the Insurance Council of Australia’s National Flood Information Database, which aggregates council flood studies, to help assess underwriting risk.

Commercial licensing arrangements mean this database is not publicly available.

Where studies are available, deciphering what they mean for individual properties is challenging.

Flood studies are technical assessments comprising aerial imagery, geological mapping, streamflow analysis, historic records and river surveys. While there is ongoing debate on the best method to communicate the risks revealed by these analyses, there is broad consensus among governments and insurers alike that they are not accessible to consumers.

The lack of accessible information about flood risk is a long-standing issue, having first been raised well over a decade ago in a review of Queensland’s 2011 flood experience. In Victoria, a state-specific review of the 2022 floods found that the lack of a publicly accessible statewide database of flood risk information limited public and local government access to crucial data and hindered preparedness and response efforts.

Despite recognition of the problem, steps to build publicly accessible datasets have so far been unsuccessful.

Addressing the challenge

Widespread adoption of insurance is important because it helps to minimise the financial burden of severe weather events for both households and governments.

But until households have ready access to information that helps them understand the risks they face, it is likely that the take-up of insurance will fall short of what’s required to safeguard against the threats posed by disasters.

The importance of high-quality hazard information is a key theme in the Government's new National Adaptation Plan released alongside the climate risk assessment. It was also emphasised in the Productivity Commission’s recent interim report on the transition to net zero.

To address this, governments at all levels should continue their efforts to inform residents about the risks in their area. This means making flood studies readily accessible and providing the resources and support to help understand them. Disadvantaged and vulnerable residents may need additional support.

Councils will likely need funding support for this to be achieved, particularly those in regional and remote areas.

Bodies like the National Emergency Management Agency (NEMA) and Geoscience Australia can play a leading role in ensuring that information is accessible and encouraging consistent approaches to risk assessment nationally. NEMA has indicated it is working on a National Disaster Risk Profile to guide mitigation investments and build understanding of current and future risks.

International examples can provide a blueprint. The UK’s flood information portal uses a traffic light system to communicate risks to households, with low, medium and high-risk categories to indicate flood dangers in a certain area, an approach that received support from insurers in last year’s flood inquiry.

As more data becomes available, state and territory governments should also investigate strengthening mandatory risk disclosure requirements that occur when someone is buying a property to explicitly include natural hazards like flood.

Making buyers aware of risks at this key moment will help raise visibility of risks and better-inform future insurance decisions.

Governments will also need to closely watch how the costs of insurance policies evolve and influence take-up, particularly for lower-income groups.

With natural disasters forecast to keep growing in frequency and intensity, Australians need a full understanding of the disaster risks in their homes to limit the hardship caused by our changing climate.

This paper uses unit record data from Household, Income and Labour Dynamics in Australia Survey [HILDA] conducted by the Australian Government Department of Social Services (DSS). The findings and views reported in this paper, however, are those of the author[s] and should not be attributed to the Australian Government, DSS, or any of DSS’ contractors or partners. DOI: 10.26193/NBTNMV

Author

Liam Dillon

Senior Economist