Explore our Progress 2050 Goal Tracker

Treasurer Jim Chalmers will hand down the 2023-24 Federal Budget amid an increasingly uncertain and challenged global economy. Inflationary pressures are proving stubborn, interest rates are rising and the global financial system is under increasing strain.

Despite these pressures, higher than forecast commodity prices, an outperforming labour market and strong company profits have lowered the deficit in the short-term. But these favourable conditions are unlikely to continue. Higher costs of living and rising interest rates are starting to dampen spending and the broader economic environment is weighing on business activity.

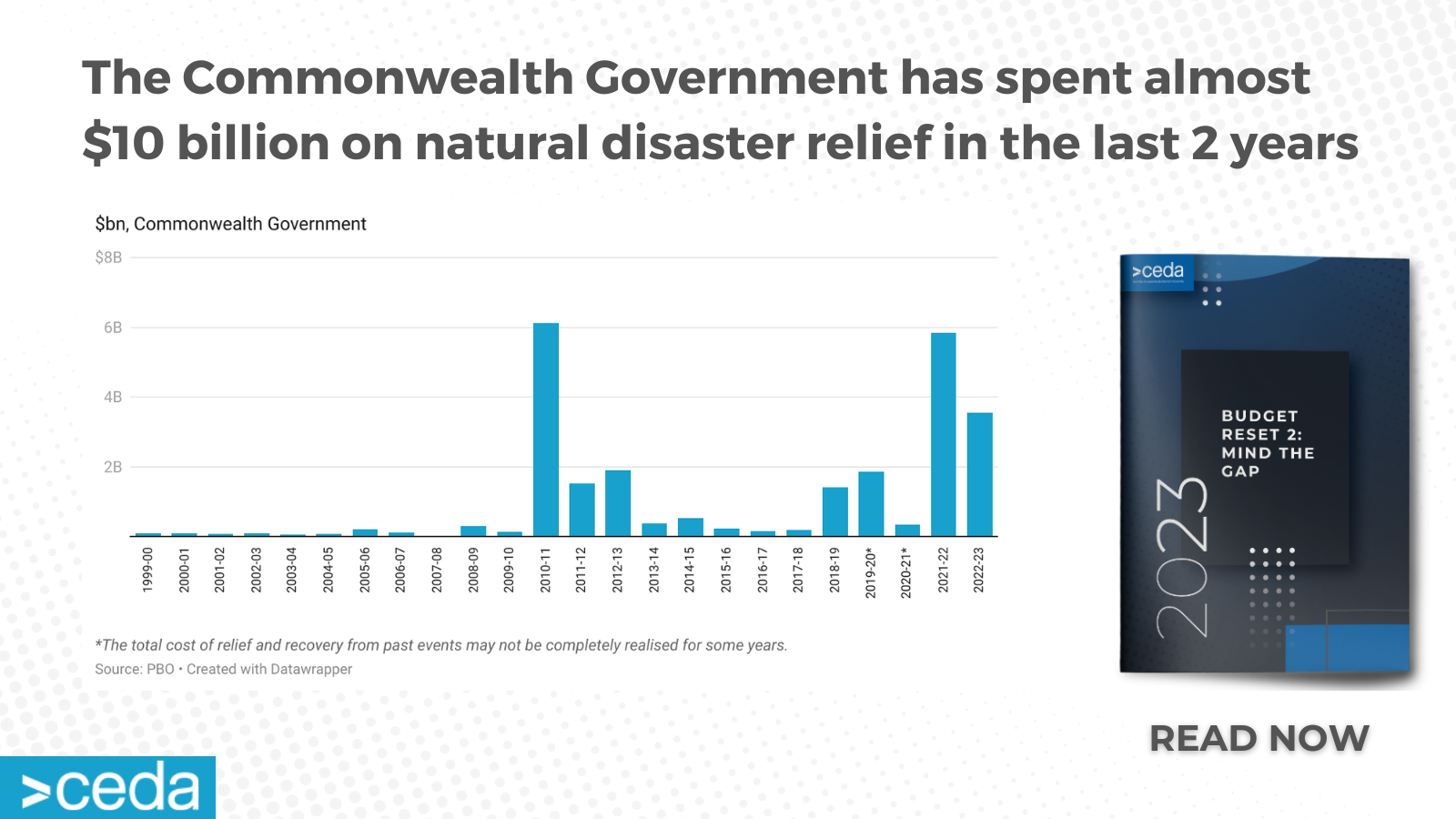

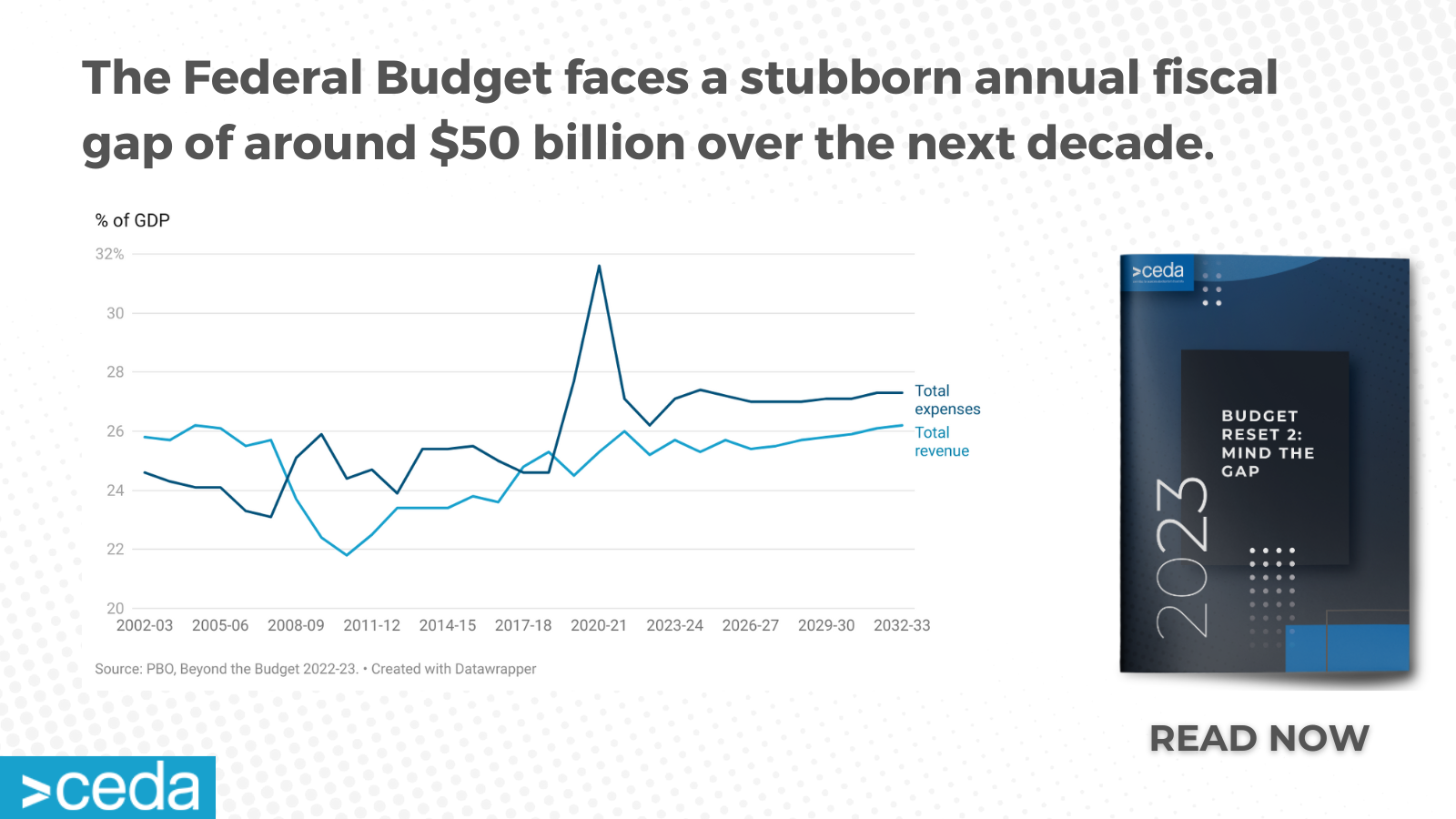

This year’s Budget and the policy decisions that follow must enable the nation to weather the difficult fiscal and economic period ahead, moving in lockstep with monetary policy to bring inflation under control while still supporting the most vulnerable in the community. Beyond this, the Government must lay the foundations on work to close the stubborn fiscal gap that will otherwise persist over the next decade.

Budget Reset 2

Jarrod Ball

Chief Economist

The immediate priority

The Government should stick to the script laid out in its October Budget, ensuring it does not stoke inflation and staying in lockstep with the Reserve Bank of Australia (RBA). It must also keep directing higher tax revenues towards budget repair and limit spending growth until debt declines.

This is a difficult balance to strike when many Australians are struggling under the pressure of increased costs of living. As CEDA analysis shows, interest costs are set to exceed 40 per cent of average disposable income for low-income households. These households will need to cut discretionary spending by more than 10 per cent to absorb increases in the cost of essential items without their overall spending increasing more than income. CEDA therefore supports targeted increases in support for these households, and particularly vulnerable groups such as single parents.

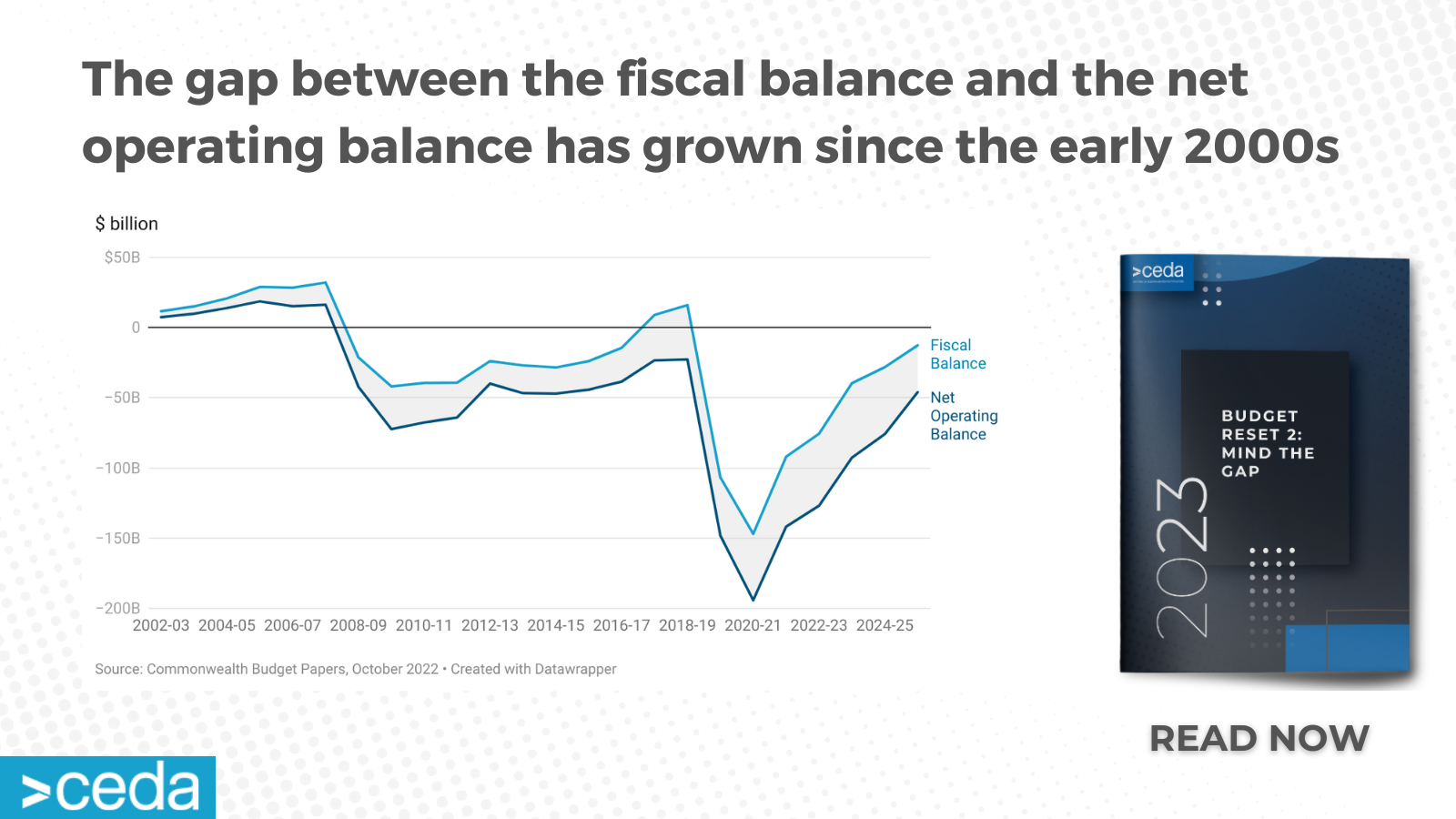

Closing the long-term gap

While this immediate strategy is the right one to pursue, the Government has admitted the last Budget did not do enough to rebuild the fiscal buffers and close the yawning deficit over the next decade.

Some have suggested a key shortcoming of that Budget was weak fiscal rules, with much greater prescription needed to instil greater discipline. CEDA does not see this as a priority in 2023. As long as the Government is meeting the commitments outlined in its fiscal strategy, stronger rules are neither necessary nor desirable at this time.

The Government’s priorities are well aligned with the International Monetary Fund’s assessment of the Australian economy. In addition, as previous CEDA research and eminent international economists have found, prescriptive and arbitrary fiscal rules often do more harm than good, or are simply ignored.

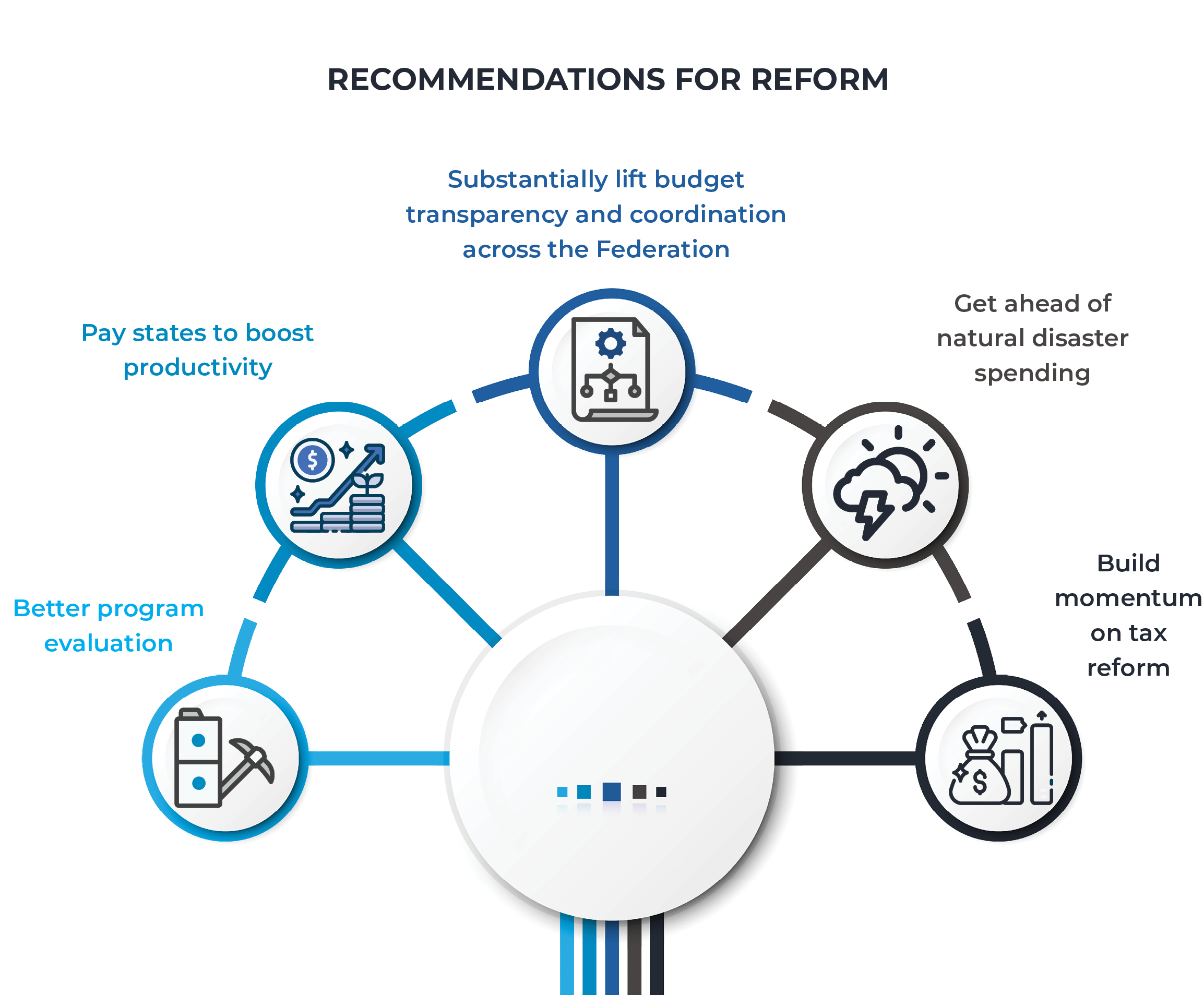

We must instead place priority on getting the right institutions, tools and policies to meet the government’s fiscal commitments to:

- Improve the efficiency, quality and sustainability of spending.

- Focus new spending on investments and reforms that build the capability of our people, expand the productive capacity of our economy and support action on climate change.

- Deliver a tax system that funds government services in an efficient, fair and sustainable way.

Without better policies and practice in these areas, the Government will be unable to close the $50 billion fiscal gap between revenue and spending that stretches across the next decade. Without a material change in the budget position over the decade, the Federal Government will be spending more each year on interest to service debt than it will on aged care or Medicare.

With the RBA review complete and a government response in train by the time of the Budget in May, the Government must now prioritise the fiscal side of the macroeconomic framework. This should be achieved by:

Budget reset 2: Mind the gap