Explore our Climate and Energy Hub

Governments must make tough policy decisions in 2022 to address cost pressures and drive economic momentum. EPO 2022 outlines key facts and insights to inform and frame the issues we need to be thinking and talking about this year. It is shaping up as a pivotal year across the economic and political spectrums, and the challenges Australia faces call for significant reform effort.

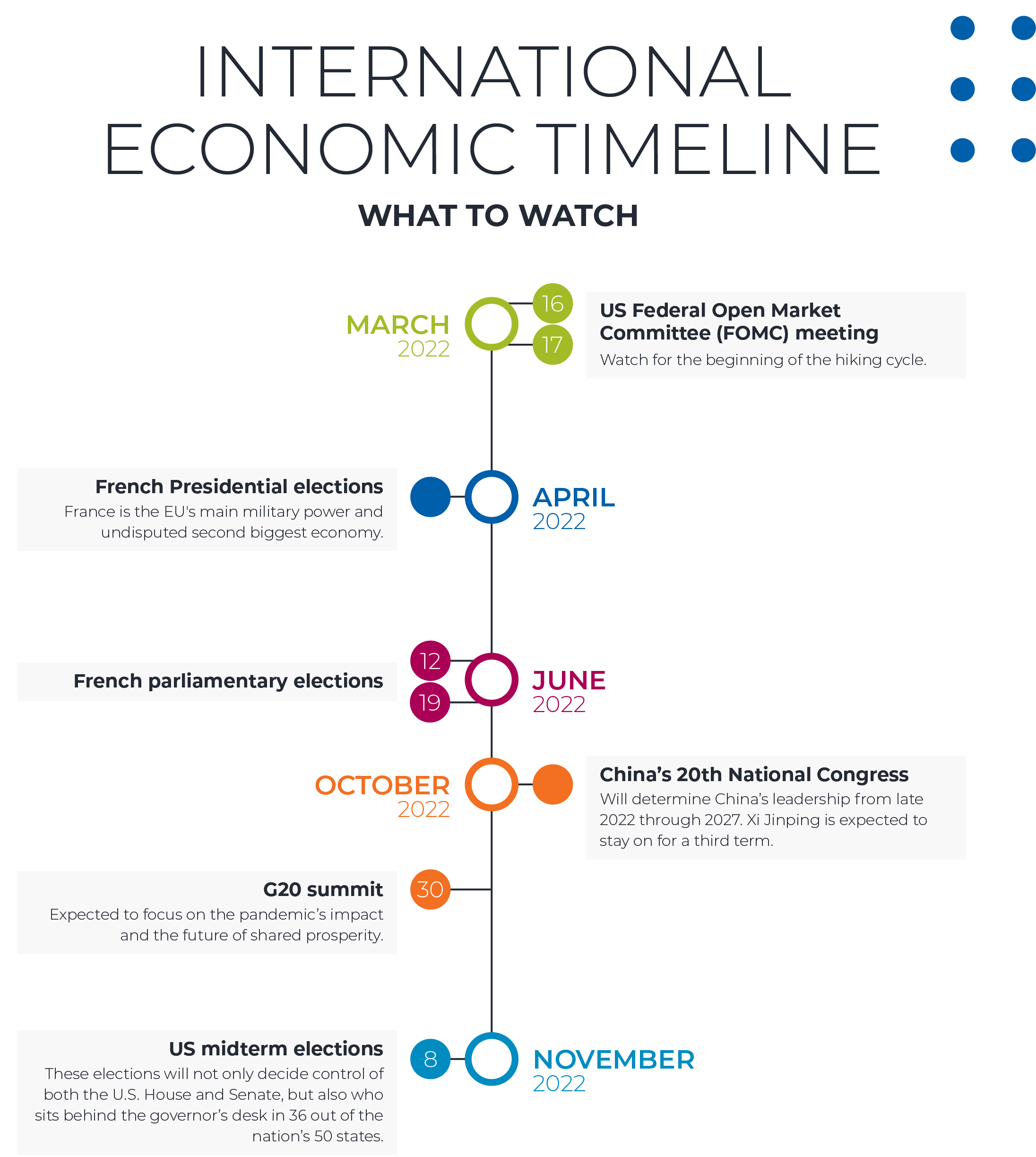

INTERNATIONAL

ECONOMIC

OUTLOOK

Richard Yetsenga

Chief Economist and Head of Research, ANZ

Interest rates are rising. How fast, how high, how fragile?

The global upswing is entrenched, and capacity tightness is ubiquitous. Omicron is the latest pandemic-related challenge to the outlook, but any negative impact on demand is likely to be transitory. As such, policy tightening and its implications are likely to dominate the narrative in 2022.

Temporary near-term challenges

COVID-19 has again dominated the early-year news flow, but on this occasion the economic debate is not just focused on the downside risks to growth. Omicron is generally impacting activity less severely than the Delta strain, but the inflation-inducing supply chain effects are also increasingly recognised.

These outcomes reflect businesses and consumers adjusting to COVID-19 and responding more effectively to each wave.

It also reflects the ongoing impacts of the unprecedented economic stimulus delivered during the pandemic.

This policy response has been very successful at limiting the structural economic damage that usually results in economies recovering haltingly from crises.

The policy response, however, has also boosted asset prices and generated inflation.

The scale of the policy response is perhaps best represented by the extraordinary monetary effects of the widespread conventional and quantitative easing carried out during this pandemic. Money supply in most economies is substantially above pre-pandemic level.

At a 40 per cent gain, the US is something of an outlier, reporting the highest money growth in peacetime. Even beyond the US, circa 20 per cent gains in money supply are common across a range of other economies; this is a rare outcome.

The combination of fiscal stimulus and quantitative easing will, mathematically, increase the stock of money. But on occasion, consumers or businesses may choose to hold a higher level of liquid funds after a crisis.

If there has been a strong rise in liquidity preference, a higher stock of money doesn’t necessarily translate into stronger spending or inflationary pressure.

In contrast to the post–Global Financial Crisis (GFC) period, there aren’t many reasons for liquidity preference to be structurally higher in the wake of the pandemic. Unemployment has fallen quickly and bankruptcies have been limited in many economies.

The pandemic will result in economic changes, but many of these are likely to be long term, rather than the acute short-term changes that might materially crimp economic activity.

While China is likely to contribute less to global growth, we don’t view it as a genuine source of global vulnerability.

Growth outlook still robust

In our view, the global growth outlook is very robust. With economic growth in 2021 at 5.4 per cent and our 2022 forecast of 4.1 per cent, it is expected that both years will be well above the global post-GFC average of 3.4 per cent.

The slowdown we expect in 2023 will only trim growth to 3.3 per cent, consistent with the post-GFC trend. Even this slowdown is unlikely to result in an increase in spare capacity.

These forecasts embody a substantially weaker growth profile in China. At five per cent in 2022, gross domestic product (GDP) growth is likely to be the weakest in modern history, aside from 2020’s pandemic-affected outcome.

However, further easing is expected to stabilise China’s credit impulse and GDP growth. Risks have risen but are likely to remain controlled. While China is likely to contribute less to global growth, we don’t view it as a genuine source of global vulnerability.

Inflation fundamentals

The advanced economies are entering this tightening cycle with the strongest inflation fundamentals since the late 1980s. In our assessment, it will take more than a small rise in interest rates to ensure that inflation remains consistent with inflation targets.

Consider what is different about this inflation cycle:

- The substantial rises in money supply through the crisis period;

- Several central banks, including those from the US, euro area, Canada and Australia, have downgraded the role of inflation forecasts and upgraded the role of current inflation and unemployment in their deliberations. Consequently, they are tightening much later (this may also mean that once tightening starts, it tends to move quite quickly);

- COVID-19, climate change and geopolitics are supply-side shocks that are reorienting supply, production and consumption patterns; and

- Commodity supply is constrained by under-investment and climate considerations, implying that prices are much more sensitive to stronger demand and less sensitive to weaker demand.

Much is made of the potential shift in consumption to services and away from goods. There are even some signs the supply chain tightness in the goods sector is easing. Shipping costs are falling from historically high levels, shipping wait times are declining, and some of the bottleneck indicators in regional Purchasing Managers’ Index (PMI) surveys look to have peaked. A shift to services spending will reduce some current sources of inflationary pressure and could also lead to some declines in inflation expectations from current high levels. However, those effects are likely to be transitory.

In the US, Australia, and other economies, inventory (relative to sales) is at very low levels, implying that goods sector production is likely to remain strong well past the peak in demand. Moreover, as goods sector inflation normalises, service sector inflation is likely to rise.

Services are labour intensive, and labour shortages are already ubiquitous in many economies. Historically, services sector inflation tends to run well ahead of goods sector inflation (Figure 4). US services sector inflation is already at a post-GFC high. While supply chain issues have contributed to the inflation impulse, the underlying driver of inflation in goods markets is excess demand. When that demand shifts to services, we should expect it to be ‘excess’ there as well.

The advanced economies are entering this tightening cycle with the strongest inflation fundamentals since the late 1980s.

Tightening is gathering momentum

The entrenched nature of inflation and robust growth outlook suggest China is likely to be the only significant economy without a tightening basis. We expect Chinese policymakers to carry out some modest easing to stabilise credit growth. In contrast, in 2022, the US, UK, Australia, India, Indonesia, Malaysia and Taiwan are likely to join New Zealand and South Korea, which have already commenced tightening cycles. The euro area, Thailand, Vietnam and the Philippines are likely to start tightening only in 2023. Significantly, we expect five hikes from the US in 2022 and another three in 2023.

Tighter global liquidity will also start to reveal pockets of financial and economic weakness in the global economy. However, consumers in advanced economies don’t seem to be particularly vulnerable to higher interest rates from current low levels.

Consumer fundamentals are the strongest in decades, with debt service ratios in some economies at generational lows – a substantial contrast to the post-GFC period.

Corporate leverage in the high yield market, some non-Asia emerging markets that are lagging the global upswing, and the financial engineering that has emerged through this pandemic seem to be more likely sources of vulnerability.

However, they don’t appear to pose threats to the advanced economy consumption story nor, as a consequence, the tightening cycle.

With inflation entrenched and the peak in global growth likely behind us, the environment for asset markets is likely to be tougher. The window of performance for emerging markets, credit and other risky assets is much narrower.

The COVID-19 pandemic has, in the most part, been a crisis of health and inequality, rather than a crisis of businesses, banks or economies. It has been a crisis in homes.

The structural agenda

Managing the withdrawal of the record-breaking policy stimulus is front and centre for policymakers. But the distributional challenges revealed, exacerbated and pre-dating this pandemic continue to require attention. The COVID-19 pandemic has, in the most part, been a crisis of health and inequality, rather than a crisis of businesses, banks or economies. It has been a crisis in homes.

Now that 80 per cent of the world economy has a zero-carbon commitment, power prices in many jurisdictions are beginning to reflect the challenges of reworking the electricity supply chain. Ensuring the costs of the climate adjustment task are broadly distributed will be critical to sustaining the effort.

Parts of the world are not recovering in line with the most robust economies, and even within the strongest economies, communities have been left behind. Inequality has widened during the pandemic and the benefits of monetary easing have not been evenly spread. Beyond the human impacts, inequality has costs in terms of political dysfunction, economic fragility and reductions in potential GDP growth.

This pandemic has focused societies on the most manifest near-term objectives – human health and safety. As the policy punchbowl is being drained, dormant structural economic issues are likely to rise. 2022 will see them at the fore.

Photos by Juliana Kozoski, Red John and Nareeta Martin on Unsplash

ECONOMIC AND POLITICAL OUTLOOK 2022

Read more chapters like this in CEDA's EPO 2022.

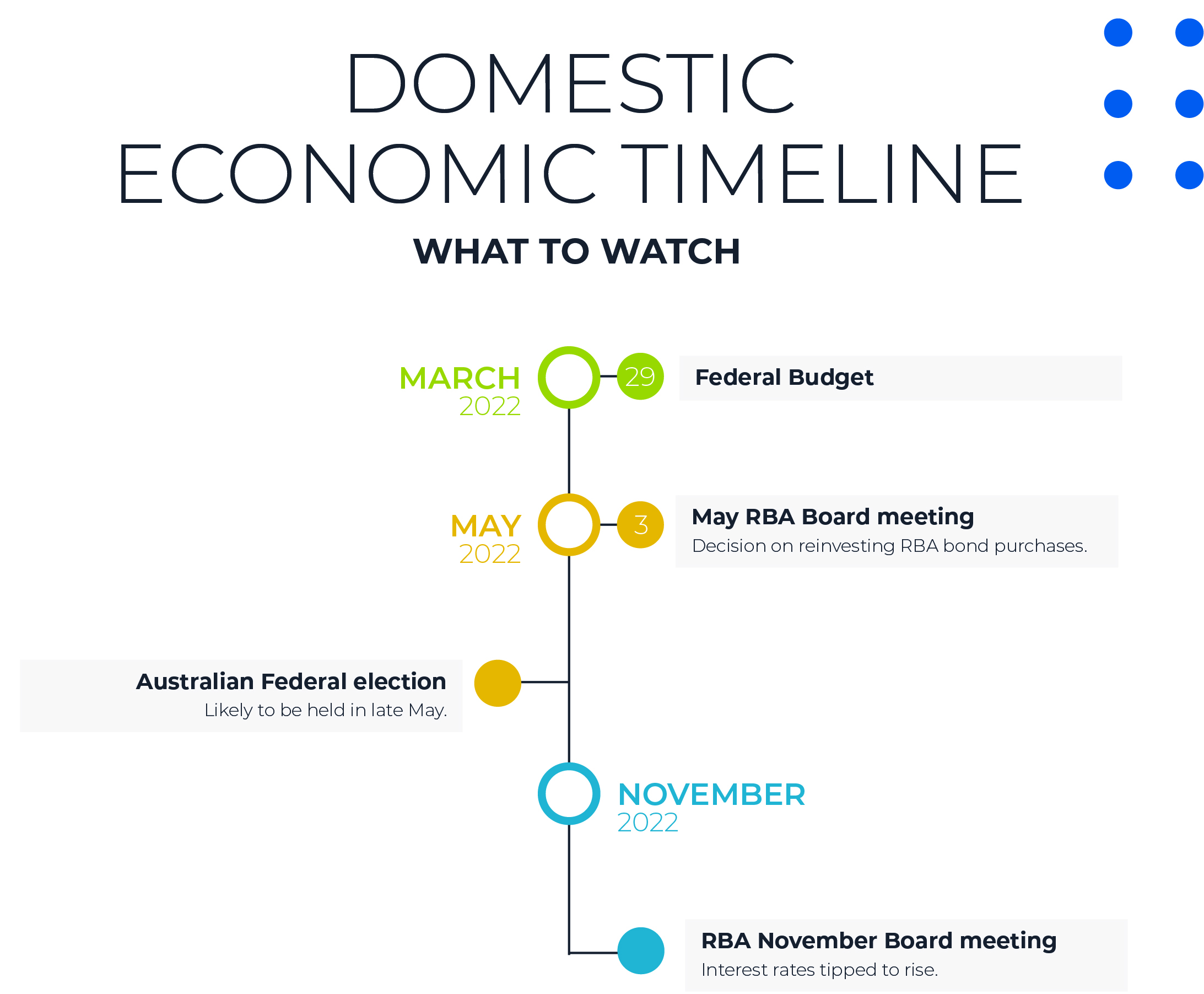

DOMESTIC

ECONOMIC

OUTLOOK

Alan Oster

Group Chief Economist, NAB

Once again as we look forward, one of the key assumptions is what will happen to COVID-19 and the new strains.

During 2021 we saw global supply shortages feeding into higher input costs locally, highlighted by supply shortages in industries such as manufacturing and construction. These shortages were due to disruptions higher up in the value chain, with raw input shortages compounded by higher transport costs (both shipping and air freight).

Pockets of wage pressure have also emerged, particularly in industries that have seen elevated demand but have been hit hard with closed borders restricting the supply of labour. That said, as NSW and Victoria reopened there were very strong rebounds in activity, especially in November as the bulk of restrictions were eased. Again, the Omicron strain has been disruptive but appears to have had different impacts and looks more like it has become a supply-side issue rather than causing a collapse in household demand.

So far, it appears the Omicron strain is much more contagious but less deadly. The focus appears to be on disruptions to business, as staff are forced into isolation through exposure or catching the virus. Some sectors will also suffer demand problems as consumers become more wary of hospitality venues, CBDs and attending big events. While it’s very early days, NAB’s consumer transaction data suggests that by late January, consumption and retail had fallen by around 15 per cent from peak levels in mid-December and hospitality was down around 10 per cent. There were also some very weak patches elsewhere in consumption – such as health, education and professional services. However, the falls are relatively moderate compared with the experience during shutdowns earlier in the pandemic. NAB’s business inward credits (revenue) data tell a similar story.

The critical assumption we are making on Omicron, and COVID-19 more broadly, is that with the help of vaccines, people will increasingly learn to live with the virus and the economy will come back strongly from mid-2022. That is, we are assuming there will be no new mutations that could force global and local lockdowns. As a result, we expect that progress on reopening international borders will continue and supply-side constraints will ease. That is also very important as a mechanism to help ease some of the supply-side driven wage increases. Though as the labour market tightens as the economy expands, a more widespread pick up in wage growth is expected. We also expect the balance between goods and services spending to normalise, though the timing and pace of this remains highly uncertain.

Fundamentally, we see a strong rebound from the second quarter in 2022 as the economy starts to operate more normally and fiscal policy supports growth in the second half.

Australian economic prospects

We are expecting strong fiscal spending to continue – as well as a previously announced tax cut in the next year due to the election – providing a support for consumer spending in the second half of the year. That applies to whoever wins government. While the fiscal stimulus will be less than last year (with the withdrawal of JobKeeper and as automatic stabilisers kick in), there are tax cuts coming and, no doubt, more election spending. As a result, we see underlying public sector demand growth of at least 4.5 per cent in 2022. Slower fiscal spending looks like more of a 2023 development.

As noted earlier, both our internal transaction data and our NAB Monthly Business Survey point to a very strong end to 2021. Based on the above, we are expecting growth of around 2.6 per cent in the fourth quarter of 2021. That would mean the drop in activity during the Delta lockdown was entirely recovered by the end of the fourth quarter – with growth during the year of around 3.2 per cent (or a year average of 4.4 per cent). Clearly an impressive rebound.

However, both the transaction data and our Business Survey for late 2021 and early 2022 point to short-term pain from the Omicron outbreak. The Business Survey showed big falls in business confidence, and a sharp weakening in forward orders and capacity utilisation in late 2021.

As a result, we are now expecting a relatively slow start to the first quarter of 2022, with growth of around 0.5 per cent in this quarter (previously we expected around 1.5 per cent growth).

Fundamentally, however, we see a strong rebound from the second quarter in 2022 as the economy starts to operate more normally and fiscal policy supports growth in the second half. Thereafter, we see slower growth in 2023 as the Reserve Bank starts to normalise monetary policy settings and house prices fall (as does consumer wealth).

The following chart shows our expected quarterly and annual growth profile for the forecast period. Broadly, we now see through-the-year growth of around 3.7 per cent (4 per cent pre-Omicron) and around 2.5 per cent in 2023 (unchanged pre-Omicron). Year-average numbers in both years are a touch higher at 3.4 per cent in 2022 and 2.9 per cent in 2023.

In brief, it shows a strong rebound in 2022 after a slow, virus-related start.

At present, the labour market is very strong, with unemployment at 4.2 per cent by the end of 2021. While the labour market has tightened significantly, that reading predates the emergence of Omicron. Based on internal data collected by NAB on the number of customers receiving JobSeeker and other employment indicators, we expect that unemployment will rise in January before falling again. A strong growth rate for the rest of the year could see unemployment below four per cent by the end of 2022 and down again to 3.7 per cent through 2023.

The graph below summarises our expectations.

Clearly, lower levels of unemployment will build pressure for wage growth, although the level of full employment remains highly uncertain. Currently, wage growth is approaching 2.5 per cent – having rebounded during the back end of 2021 – and the NAB Business survey showed that labour cost growth continued to track at high rates in December, likely also reflecting an element of wage rises in addition to the expansion in employment. Clearly the virus is keeping wage pressures tight, and while we see some scope for a return to more normal conditions in the second half of 2022, a tighter labour market will keep the pressure on. While it’s difficult to measure, it now appears that an unemployment rate below four per cent is necessary to generate a sustained generalised increase in wages. Remember, the RBA is looking for wage growth in excess of three per cent.

However, our December Business Survey saw very high increases in purchase costs (especially in manufacturing and wholesale) while retail inflation remained elevated at near record levels.

Considering the above, the graphs below show our expectations for wages growth (using the ABS Wages Price Index), and the core and headline CPI.

On core inflation, it is important to remember the RBA seems to be signalling that they are prepared to run the economy hotter than normal and will only react to runs on the board rather than forecasts. Also, they seem to have a razor focus on wages, and it will take substantial time to determine whether the current surge in wage price measures is temporary or not. Overall, we see the RBA bringing forward the start of rate hikes to late in the fourth quarter (November). Much will depend on the current strength of the data continuing. Here it is important to note that we disagree with market pricing, which has a start point by early-2022, and consequently the number of hikes – i.e. degree of tightening in 2022 (markets have five rate rises in 2022). That said, when the RBA does finally start to lift rates, it will undertake a steady series of increases. We see the cash rate approaching one per cent by mid-2023 and around 2.5 per cent by late 2024.

While it’s difficult to measure, it now appears that an unemployment rate below four per cent is necessary to generate a sustained generalised increase in wages.

Currency and house prices

The other important issues are the currency and house prices. On the Australian dollar (AUD), our models still see the AUD/US dollar (USD) as under-priced, given strong commodity prices and a strong economy. For 2022, we see the AUD rising during the year to reflect that view and remaining around US75 cents into 2023.

House prices are always of interest – not just because of Australians’ interest in the topic but also because the wealth effects are real. At present, we are seeing a slowing in the growth rate of some major markets – Sydney and Melbourne – but not everywhere (Brisbane, Adelaide, and rural Australia are still seeing rapid growth). Over time we see affordability issues as slowing the momentum of the current market – with a relatively flat second half of 2022 before prices falling by more than 10 per cent in 2023. The latter might sound concerning but needs to be put beside the nearly 25 per cent+ increase in prices over the two previous years.

We see the RBA bringing forward the start of rate hikes to late in the fourth quarter (November).

Summary

As always, there are lots of uncertainties in the forecasts – and even more at present. On the activity side, the direction of the virus and whether (as we assume) the local and global economies learn to live with the virus via vaccines by mid-2022 is particularly important. Also, geopolitical uncertainties loom large in Eastern Europe and North Asia.

However, our base case remains that the Australian economy rebounds strongly after a slow (virus-impacted) start to 2022, with the unemployment rate falling below four per cent by the end of 2022 and edging lower into 2023. Wage and price pressures are likely to remain elevated but stabilise in late 2022. The AUD is likely to stabilise around its long-run average of USD 75 cents by 2023 and house price momentum could stall in late 2022 before falling in 2023.

Economic policy will be a key theme for the year. Fiscal spending will remain elevated in 2022 regardless of who wins the election, supporting consumer demand in late 2022, but eventually the budget will need repair. On monetary policy there are additional uncertainties. While in our current view, wage and price pressures could see the RBA start to adjust rates in late 2022, a lot depends on what is determined to be transitory on the inflation front and whether the RBA sticks to its guidance that it will wait for hard evidence of inflation sustainably within the band. This is no easy task, especially in the context of the supply-side forces presently at play. Many of the variables likely to feed into the RBA’s framework for assessing stable inflation and where rates need to be to keep inflation low and stable are very hard to assess in real time. The true level of full employment and how quickly any tightness in the labour market feeds through to faster wage growth is just one of these considerations.

In the medium term, the theme will likely be a focus on productivity growth and business investment, as well as population growth. These factors will become important as the support from fiscal and monetary policy fade and fiscal repair begins.

In short, a reasonably optimistic outlook in the near term, albeit with probably more than the usual uncertainties around the forecasts, before a renewed focus on the true underlying pace of growth in the medium-term.

Our base case remains that the Australian economy rebounds strongly after a slow (virus-impacted) start to 2022, with the unemployment rate falling below four per cent by the end of 2022 and edging lower into 2023.

Photos by Joey Csunyo, Sparks Reliance and Nao Takabayashi on Unsplash

ECONOMIC AND POLITICAL OUTLOOK 2022

Read more chapters like this in CEDA's EPO 2022.

REGIONAL

ECONOMIC

OUTLOOK

David Robertson

Head of Economic and markets Research, Bendigo and Adelaide Bank

The onset of COVID-19 in early 2020 shocked the world, but despite understandable global fears of dire economic consequences, the start of 2021 saw the focus shift to recovery, promise and opportunity in the post-pandemic world.

In Australia, the initial policy response – heath, fiscal and monetary policies – proved to be very effective in minimising the economic damage while also protecting the health system, evidenced by employment and GDP returning to above pre-pandemic levels by mid-2021, while our mortality rate per capita remains one of the lowest in the world.

However, prior to and since the Delta and Omicron variants, the impact of the COVID-19 recession and the pace of recovery have been uneven and indiscriminate. A prime example of this unevenness can be seen by contrasting the shallower economic contraction in regional Australia versus the capital cities. Similarly, regional Australia offers an understated yet significant role in recovery and a unique opportunity in reimagining the nation’s future.

We anticipate slower appreciation of property prices in the year ahead, but still an outperformance in regional property over the capitals.

Regional Australia through the pandemic

The initial phase of the pandemic left economists contemplating just how deep the recession would be, as lockdowns saw mobility and household demand collapse. Simultaneously, dramatic forecasts for asset values (stocks, property and commodities) hit the markets, and stocks did suffer their largest one month fall on record in March 2020.

However, the stunning rebound in the value of these assets revealed the hazards of making predictions in a once-in-a-century event.

Moreover, a range of unforeseen consequences of the pandemic has followed. Far from creating a collapse in property values, COVID-19 helped fuel a property boom, and regional Australia has led the charge.

The sudden imperative to work from home and stay away from CBD offices put new technology to the test, and together with the digital infrastructure, the technology delivered. Further, a natural inclination to seek more open space and other lifestyle choices has seen a reassessment of the inherent value of property and its location. The data below from CoreLogic shows how this played out in 2021.

Capital city dwelling values rose by 21 per cent for the year, but regional values rose on average by more than 25 per cent, with all states experiencing unprecedented gains for regional property.

Our bank’s internal data also points to housing finance demand increasing in regional locations, including via the First Home Loan Deposit scheme. Housing affordability is an immense challenge for aspiring home owners, and the latest spike of house prices appreciating at a rate much faster than wages leaves some capital city locations out of reach.

Relativities for house prices are therefore a growing factor, driving relative price increases hand in hand with lifestyle choices, given the median dwelling value in capitals is $790k versus $540k for regional housing. This gap has been narrowing, and recent data suggests the higher demand for regional property will carry through to the endemic phase of ‘living with the virus’.

This nascent trend away from capital city CBDs and high-density, high-rise property is evident not only through house prices but also in population trends. For the first time in more than a century, Australia’s population contracted in the third quarter of 2020 due to closed international borders, but at the same time, a regional renaissance was underway.

The latest Regional Australia Institute ‘Regional Movers Index’ shows population flows from capital cities to the regions maintained a trend that gathered pace during the pandemic: more people moving away from capital cities to regional areas than in the opposite direction.

The number making this move grew again in the 2021 June quarter by 11 per cent compared to the same quarter in 2020. ABS data showed a record net 11,800 people left the nation’s capital cities in the March quarter of 2021, with regional Queensland the primary beneficiary.

The outperformance of regional property is also matched by a sharp rise in farm values, with the Australian Farmland Values report showing a 12.9 per cent increase in 2020 (bringing the 20-year compound annual growth rate to 7.6 per cent).

Another significant rise in 2021 is expected as the confluence of factors, including record-low interest rates, favourable seasonal conditions for the second year in a row (and now with a new La Niña event declared by the BOM), and elevated levels in agricultural commodity prices drive even more robust demand for agricultural assets.

Regional Australia has performed resiliently throughout the pandemic despite the lockdowns in early 2020 and again in 2021, with the NSW, ACT and Victorian Delta strain lockdowns applying to all LGAs, not just the capitals.

Aggregate spending data via Bendigo Bank’s Spend Index (tracking median daily spend in all states and territories) shows much less impact on consumer spending throughout lockdowns for regional Australia than the capital cities prior to the indices converging post lockdowns. The index also shows increased activity versus pre-pandemic trends, matching ABS retail sales data, and again demonstrating the effectiveness of fiscal and monetary support throughout the pandemic.

The lack of availability of suitable labour remains a significant challenge for businesses in capitals and the regions, but the impending reopening of international borders should help to alleviate some of these constraints. Nevertheless, job vacancies and job advertisements are at record or multi-decade highs, and (despite recent population flows) regional job vacancies are at a record high based on Regional Australia Institute data1.

The most recent Seek Job Ads report revealed another sharp rise in advertised positions nationally, now up 52 per cent on pre-pandemic levels, with the most significant increases seen in hospitality, tourism and agriculture. The unique challenges of the pandemic have delivered remarkably uneven impacts by industries, demographic groups and locations – but the resilience of regional Australia is compelling based on a range of data: demand for property, population flows, employment and consumer spending.

Decentralisation and leveraging the sheer size of our continent (with its low population per square km ratio) is a compelling proposition.

The outlook for regional Australia in 2022

As we move from the pandemic era with frequent lockdowns and constraints on mobility to ‘living with the virus’, including possible new variants of COVID-19, many of the changes in consumer and household preferences seen over the last two years are likely to persist. Among these is regional Australia’s sudden appeal to a broader range of people due to health and lifestyle considerations, enhanced by technological adoption. While these drivers will evolve, they mark a reset moment in attitudes and expected population trends.

We anticipate slower appreciation of property prices in the year ahead, but still an outperformance in regional property over the capitals. After gains of 21 per cent for capitals and 26 per cent for the regions, we expect closer to five per cent in 2022 but have pencilled in four per cent for urban dwellings versus six per cent for regional values. As international borders reopen, the return in demand from overseas will be a factor, as will the recent increase in fixed rates amid inflationary pressures. Official RBA rate hikes commencing around August 2022 may see a mild pullback in values in 2023, but all in the context of significant gains.

Population trends are expected to pick up this year with a 1.25 per cent increase nationally (after last year’s near-zero net growth), but regional flows are likely to maintain their recent trend, hand in hand with property demand. Regional hubs within a few hours of capitals have seen the largest inflows, and employment growth in these locations is also expected to maintain its momentum.

We expect the unemployment rate nationally to trend down to below four per cent over 2022, with tight labour markets driving wages growth of close to three per cent. High job vacancy rates and business confidence are expected to combine favourably with elevated levels of household savings and ‘accrued stimulus’ to drive a robust recovery in the short term. Living with the virus will require flexibility and adaptability, but the experience of the last two years shows our form in that field, especially in regional Australia.

The outlook for the rural sector is also favourable thanks to strong global demand for agricultural commodities and improved conditions for production after two strong seasons. Momentum in this sector will add to domestic demand (especially in regional hubs) for equipment, goods and services, albeit complicated by recent weather events, including floods in some locations.

2022 is expected to be characterised as a year of strong demand throughout Australia, driven by reopening borders amid high vaccination rates coinciding with high household savings rates. What is less clear is how well supply can keep up with demand, be that labour supply (record job vacancy rates) or supply chain disruptions impacting imported goods and materials. Inflationary risks abound, but tight labour markets are likely to bring a welcome uptick to wages growth, and regional Australia will play a crucial role in the necessary recovery in jobs, wages and production to meet demand.

The opportunity for the decade ahead

A once-in-a-century event of this scale does offer a unique opportunity for reshaping and positioning our economy for the future. Recent trends already indicate a renewed willingness to embrace regional Australia, and the advantages of decentralisation and a more evenly distributed population are many and varied. In considering the main challenges our nation faces in the decades ahead, decentralisation and leveraging the sheer size of our continent (with its low population per square km ratio) is a compelling proposition. Three such challenges (and opportunities) are detailed below.

Housing affordability is an immense challenge for aspiring home owners.

Housing affordability

Increases in residential property have been outpacing income growth for decades. There are steps that can be taken to improve the income side, including productivity enhancement measures. However, a critical factor in addressing affordability is supply.

The chart below shows the affordability challenge evidenced by sharply higher price-to-income ratios, although it also shows that household debt to income is largely unchanged. As such, this is an issue for affordability rather than a debt issue. The pandemic has added to wealth inequality, so this adverse outcome demands a response.

The ability to add rapidly to the stock of available housing depends on available land, which is much more viable in urban fringes and regional Australia than elsewhere. Population flows are already creating shortages in many regional cities, and the latest CoreLogic rental survey showed that regional rental growth has reached 12.5 per cent, its highest rate on record since the index began in 2005. This national problem can be assisted by accelerating supply in the regions with the greatest capacity, and importantly the demand for new dwellings in these locations is already evident.

Decentralisation can address housing affordability and the equitable access of home ownership by:

- Increasing the supply of suitable housing, taking advantage of developable regional land;

- More efficient local government zoning and planning systems; and

- Development of social and affordable housing, assisted by government investment.

Migration

Closed state and international borders have created a wide range of problems for the economy, including labour shortages, a collapse in tourism and a significant hit to international student numbers. The reopening of borders now has the vital recovery process in these sectors underway, but the longer-term opportunity of higher net migration to Australia is immense.

As the 2021 Commonwealth Intergenerational Report (IGR) explained, our demographic challenges ahead (especially due to an ageing population) demand much higher productivity growth to lift standards of living, as ageing reduces labour force participation. The IGR modelled net migration to only return to pre-pandemic levels (235,000 per year, as per current Government policy).

However, the uplift to GDP and therefore to income and standards of living would be greatly enhanced by ‘proportional migration’, as this chart shows, and an acceleration of this process can drive faster growth sooner.

Proportional migration (increasing net overseas migration to a constant percentage of our population) would help to offset the lower natural population growth rate Australia is experiencing, and bridge the gap created by the pandemic. The economic benefits are delivered in part by enhanced growth, and the logistics of increased migration rates can be solved by the capacity of regional locations.

Australia’s skills shortage in the short term will be helped by greater access to workers from around the world, but the immediate challenges addressed by the reopening of borders for skilled migrant workers must not be confused with the longer-term opportunity that higher immigration rates offer.

At the same time investment in human capital via education and skills reform, and increased funding for universities and the vocational education and training (VET) system is needed to build capability for jobs of the future (which will increasingly require higher levels of education, as AI and automation reshape the workforce). This in turn needs commensurate investment in regional, rural and remote education and training needs.

Regional Australia will play a critical role in the transition to a low-carbon future but simultaneously offers enormous opportunity via new industries including green hydrogen, solar and wind energy, and carbon sequestration.

Climate

Regional Australia will play a critical role in the transition to a low-carbon future but simultaneously offers enormous opportunity via new industries including green hydrogen, solar and wind energy, and carbon sequestration. Australia has a comparative advantage in its geography and its natural resources to compete on renewable energy, as economist Ross Garnaut has clearly outlined2.

Innovation is a key driver of productivity and lifting standards of living and is a prerequisite to solving the global challenge that climate change poses. Increased ‘marginal’ farming land has demanded quantum leaps in AgTech, and Australian farmers are at the cutting edge of agricultural innovation. Agriculture is inextricably linked to Australia’s national prosperity and our identity.

Regional Australia can be a vital contributor to ‘inclusive growth’, i.e., economic growth that is sustainable, equitable and more evenly distributed across society. This role can be enhanced by appropriate investment in regional infrastructure, in human capital (education and training) and in natural capital. Decentralisation and diversification add to economic resilience, which will be increasingly challenged in the decades ahead as demographic change meets climate change.

The short-term recovery from the pandemic does appear to be on track, however realising the nation’s full potential in a sustainable manner will require better distributed population growth. This will need a focus on investing in the liveability of a range of regional hubs, including access to digital infrastructure and enablers of innovation, resilience and sustainability.

Photos by James Dimas, David Goulding, Josh Withers and Jeremy Bezanger on Unsplash.

Footnotes

1 ‘Regional Job Ads Continue Rising’, accessed at 27 January, 2022

2 ‘Energy: Superpower: Australia’s low carbon opportunity’, accessed at 27 January, 2022

ECONOMIC AND POLITICAL OUTLOOK 2022

Read more chapters like this in CEDA's EPO 2022.

POLITICAL

OUTLOOK

Michelle Grattan

Associate Editor (Politics) and Chief Political Correspondent, The Conversation

As we look to 2022, a central feature of the next few months will be the uncertainty of everything – health, the economy and politics.

Even if the initial variant of Omicron has peaked, we don’t know where the virus will go next, as subvariants and new variants emerge. And that will have fallout for the economic outlook and the political battle.

The focus of the first half of the year is the election, which will be in May, and watchers predict the outcome of that at their own risk. Before the 2019 poll, most observers were unafraid to call what they saw as the likely result. Most ended up wrong. This time, players and analysts are cautious. Partly because it’s really hard to judge where things are at; partly because of the memory of being burned.

After Morrison won his ‘miracle’ election, the immediate conventional wisdom became that he was unbeatable. That analysis was too much of the moment. Even before COVID-19 turned the world upside down, Morrison’s mishandling of the 2019-20 bushfire crisis, with his Hawaiian holiday, indicated his political judgement was not as astute as many had assumed; it was also an early sign that the ‘daggy dad’ image would not necessarily work well in the longer run.

For Morrison, COVID-19 management has been a mixed, ever-changing – and still changing – story. There is no doubt Australia has had much success over the past couple of years, arising from some good decisions, starting with the swift international border closure. Equally, there has been a series of failures and Morrison has borne much, though not all, of the blame for them.

Coming to where we are currently, the Omicron wave combined with the government’s handling of it feels like sandpaper on the now sensitive skin of an Australian public that has been through so much. In particular, the lack of Rapid Antigen Tests, along with the hassles and anxieties in getting children vaccinated, have translated into political irritants. Beyond that, the death toll (in terms of absolute numbers) in the early weeks of January became alarming, although that toll seemed to receive less attention than might have been expected. Many people appeared to have accepted that ‘living with COVID-19’ means accepting a substantial number of deaths. On the other hand, the ability to manage COVID-19 is still high in people’s priorities. When Newspoll asked respondents in January what the most important issue was when deciding who to vote for, leading Australia’s recovery out of COVID-19 came out top.

Late last year the Morrison government hoped people would have a good Christmas, as restrictions eased and most borders (although not Western Australia’s) were open. Omicron meant things worked out very differently. So the voters are jumpy, fractious, potentially volatile.

In the elections since COVID-19 hit in early 2020, pandemic management has worked to the benefit of incumbents, most notably in the strong return of the Queensland Government and that extraordinary result in WA. The question now is whether COVID-19 will no longer protect governments. The first test of that will be the South Australian state election in March, where the Liberal government has also had a series of problems unrelated to COVID-19. The big test will be the Federal election.

The first Newspoll of 2022, taken in late January, was a shocker for the government. Labor was ahead 56-44 per cent on a two-party basis; Morrison’s net satisfaction rating had plunged 11 points to minus 19; Anthony Albanese was breathing down his neck as better PM.

In the elections since COVID-19 hit in early 2020, pandemic management has worked to the benefit of incumbents, most notably in the strong return of the Queensland Government and that extraordinary result in WA.

Polling and anecdotal evidence indicate voters have turned off Morrison. His character has come under assault, with allegations he is a 'liar'. The government is struggling. But there remains a big question mark over whether Labor has enough heft to get across the line. Albanese’s small-target strategy has studiously avoided the mistakes of 2019, when the opposition’s policy overload was a dead weight for Labor. Albanese is not disliked, as Shorten was. But nor is he defined in the public mind. Although he has been a senior minister and rose to deputy PM, many voters don’t have a grip on him personally or what he stands for. Albanese hopes he can rectify this in the campaign, but one has to ask, if people don’t know him after all this time, can that really be changed at the eleventh hour?

Anyway, if COVID-19 is as bad in May as it is now, will that actually work for Morrison, with anxiety inclining people to stick with the status quo?

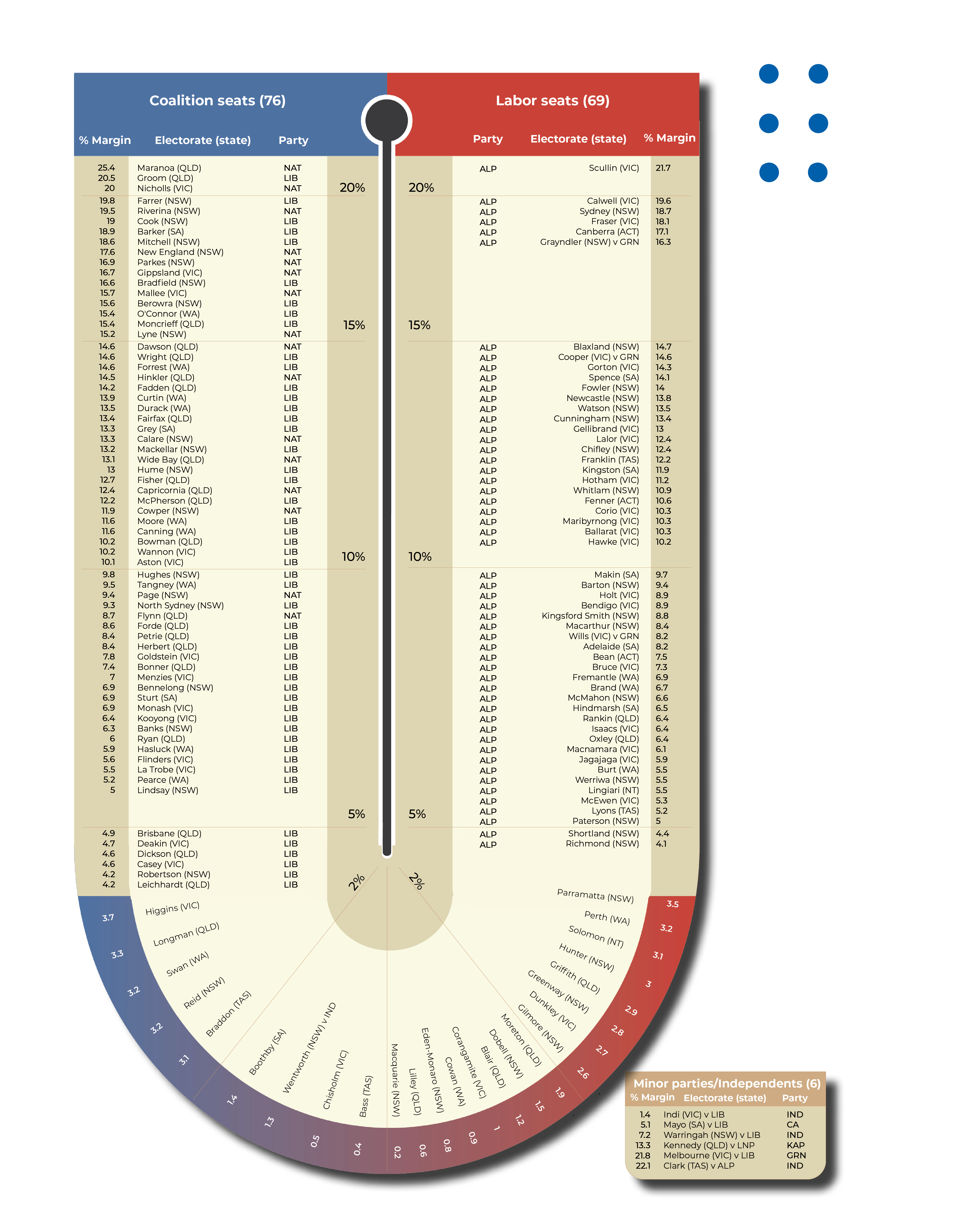

The electoral map shows the tight starting point. ABC election analyst Antony Green says that after the redistribution, the government will go into the election with 76 seats (that’s counting Hughes in NSW, the seat of defector Craig Kelly, as Liberal) and Labor with 69. The magic number for majority government is 76 in a 151 member House of Representatives. Labor requires a uniform swing of 3.3 per cent to get the seven seats for majority government (of course, swings are never uniform). Significantly, there is a big difference between the two sides in the number of marginal seats. Labor has 12 on margins of under three per cent; the Coalition has only three.

The numbers show how easily we could end up with a hung parliament. They also indicate how important local campaigns in individual seats will be, and it is often hard to know what is going on down in the weeds.

Data courtesy of Antony Green, ABC Election Unit – Jan 2022

Notes: Queensland LNP members allocated as Liberal or National based on party room joined after election.

Margins for Victoria and Western Australia are notional based on adjusting 2019 result to take account of redistributions in each state. The redistributions have seen the WA Liberal seat of Stirling abolished and a new notional Labor seat named Hawke created in Victoria. Margins are based on two-party preferred majorities except where alternative party margins are indicated. Margins based on results of 2019 election and do not take account of members resigning from their party (Craig Kelly in Hughes).

Party codes: Liberal (LIB), National (NAT), Labor (ALP), Greens (GRN), Centre Alliance (CA), Katter’s Australia Party (KAP), Independent (IND)

The government is at high points in Queensland and WA, where its challenge is to avoid or minimise losses. The battleground states are NSW, Victoria and Tasmania. In particular, the Coalition is pinning its hopes on improving its numbers in NSW.

The government’s central pitch will be the economy and its credentials on economic management. In December at the time of the budget update, this looked like very strong ground. What we don’t know is how much Omicron will knock the economy around, although the expectation is less than in earlier waves with their lockdowns. But one thing should be noted: the next set of national accounts, released in March and the only set out before the election, relate to the December quarter before Omicron hit. So they will be positive. Unemployment will be low, and interest rate rises still only a spectre, at the time of the election.

For the third consecutive time, the Coalition will launch an election off the back of a budget. This worked well in 2019 but badly in 2016, when Malcolm Turnbull took the government to the brink of defeat.

Despite the earlier speculation of a possible March election (which was rendered impossible by Omicron), Morrison’s preference always seemed to be to have a budget first, for a May poll. Whatever the risks, launching from a budget gives the government the opportunity to frame the debate, forcing the opposition to respond, embracing or rejecting budget measures.

The government lacks much in the way of a forward agenda. It has shown itself short on reform ambition, partly because of COVID-19 but also because Morrison is more manager than reformer. A modest effort to get industrial relations change fizzled. But it’s unlikely that the lack of a serious reform program will count significantly against the government: COVID-19 means people are very much concentrated on the here-and-now.

Launching from a budget gives the government the opportunity to frame the debate, forcing the opposition to respond, embracing or rejecting budget measures.

On climate change, late last year Morrison went through an agonising negotiation with Nationals leader Barnaby Joyce to have the Coalition embrace the target of net zero by 2050 (but with only a medium-term ‘projection’, not a target). This was aimed not just at the Glasgow climate conference, but also to try to neutralise climate as an election issue. Labor followed with a policy only a little more ambitious than the government’s, but with considerable detail. The high-profile independents who are standing in ‘leafy’ Liberal seats will elevate climate as an issue. But it is not likely to be as important as in 2019 when Shorten was very vulnerable with a bold and uncosted policy, and the Adani issue ran hot. This time, neither side really wants climate change at the centre of the campaign, even if the independents do.

Another issue that the independent candidates will push hard will be an integrity commission, which the government promised and failed to deliver. There is no doubt the government is on the back foot on that.

We can expect most of the current House of Representatives crossbenchers to be returned (but not Craig Kelly, despite Clive Palmer’s money). While the high-profile independent aspirants seeking to enter parliament will get a lot of attention in the campaign, they will face uphill battles to win seats – one, at the most two, might make it. But they will tie up Liberal party resources in many seats.

Apart from its pitch on economic management, the government will launch a strong campaign against Albanese personally. We saw this in the recent concerted attacks on Albanese over policy towards China, with the suggestion he lacked the ‘ticker’ to stand up to that country’s belligerent assertiveness. In fact, there’s very little difference between the government and opposition on China policy, but the government is desperate to talk up national security as an issue.

One last thing, don’t expect too much from this election campaign in the way of vision for the future. The government is just about survival; the opposition is about trying to fall into office. The result will be fascinating, the campaign probably depressing.

Photos by Aditya Joshi on Unsplash.

ECONOMIC AND POLITICAL OUTLOOK 2022

Read more chapters like this in CEDA's EPO 2022.

POLICY

OUTLOOK

Jarrod Ball & Cassandra Winzar

Chief Economist & Senior Economist, CEDA

COVID-19 will continue to be front of mind for policymakers in 2022.

Two years in, the COVID-19 pandemic has significantly disrupted lives and livelihoods and its impacts will continue to be felt for some time.

Free movement of people and goods across borders is still impeded, driving acute workforce shortages and exhausting Australia’s health system. While many workforce shortages were inevitable as borders were shut and more Australians contracted COVID-19, the pandemic has exposed poor coordination and underinvestment in Australia’s education and skills pipeline, including in critical care sectors.

Significant fiscal support was rightly deployed to cushion the economic impact, but it will also leave elevated debt running headlong into demographic strains on the budget and major spending commitments to services highly valued by the community.

Even before COVID-19, the 2020s were going to be pivotal to Australia’s economic and social development. The long-term challenges of an ageing population and climate change are approaching an inflection point, where more deliberate and urgent policy action is required.

In the absence of strong productivity growth, Australians’ living standards have grown more weakly than in the past. Moreover, a significant proportion of Australians remain shut off from economic opportunities, including those in entrenched disadvantage and Aboriginal and Torres Strait Islanders, while gender gaps across many metrics remain unacceptability wide.

The long-term challenges of an ageing population and climate change are approaching an inflection point, where more deliberate and urgent policy action is required.

Fiscal policy and tax reform

Federal elections risk cash splashes, but careful decision-making about how to improve the quality and direction of spending is crucial given the myriad of major spending programs facing significant demands.

While ongoing COVID-19 disruptions mean some targeted fiscal support will continue, the Federal government must re-anchor the fiscal strategy for the long-term.

The 2022-23 budget will be navigating a much different set of circumstances that have evolved in less than 12 months. Demand has picked up and there is considerable future potential stimulus if precautionary savings are unleashed.

Employment is growing strongly, with the potential for unemployment to have a three in front of it in 2022, inflationary pressures have picked up but much less than in other economies and government debt is materially higher but manageable at record low interest rates. The key economic challenges are on the supply side.

These circumstances require different anchors to guide fiscal policy. The government should adopt new anchors, including an appropriate benchmark for debt sustainability. This could be based on real interest payments as a proportion of GDP to account for the impact of both interest rates and prices growth on debt sustainability.

In the longer term, the focus should shift to addressing the intergenerational pressures in the budget. A change in paradigm will be necessary, including targets to address and reflect ageing-related costs in the budget through sustainable changes to the structure of revenues and expenditure.

Recent medium-term fiscal strategies have included arbitrary tax-to-GDP ratios and the unrealised ambition of budget balance over the economic cycle. As the International Monetary Fund has noted, being bound to strict tax ceilings can lead to cyclical improvements being seen as an opportunity for permanent tax cuts. In some cases, such fiscal rules have driven greater budget discipline for a period (as assessed by headline measures), but they have not improved the quality of budget measures or economic and social policy outcomes.

The pandemic has further highlighted the importance of highly productive firms with strong technological capabilities, as these firms have been most resilient and increased employment more during the pandemic.

The task of maintaining fiscal sustainability in the medium term is made both more important and difficult by the growing demographic impact on the budget. Under current tax settings and with the percentage of the population that is working age peaking in 2009, we now have growing strains on the revenue base at the same time as increasing demand for services and support for an ageing population.

We need a revenue base that is capable of sustainably funding critical public services into the future, and to address the right balance of personal funding of services, particularly aged care. Community expectations of the level and breadth of care to be provided are unlikely to be met through government funding alone. This will be a delicate balance but must be addressed.

These challenges imply that serious tax reform is inevitable at some point in the next decade to strengthen the revenue base while at the same time meeting the future needs of our economy. This includes ensuring it does not unnecessarily impede innovation, investment, saving or risk-taking and contributes to a dynamic and diverse economy.

Continuing increased reliance on personal income taxes and a relatively narrow focus on wealth and consumption taxes when the proportion of the working-age population is shrinking is simply unsustainable. The pandemic has also provided further evidence that the revenue imbalance between the federal and state governments results in the continuing proliferation of fiscal transfers that increase bureaucracy and reduce agility and accountability in the federation.

Economic dynamism and tech

At a time of supply-side challenges, productivity and dynamism of the economy need a sharper focus by policymakers.

Dynamism includes the process by which businesses are continually starting and failing, expanding and contracting. It enables innovation, risk-taking, entrepreneurship and skills development. These are the key ingredients to our productivity and competitiveness as a nation, and our ability to expand existing industries and develop new industries on the world stage, in turn boosting wages and living standards.

Productivity growth contributed more than 80 per cent of the growth in Australians’ incomes over the last three decades, but has slowed significantly since the early 2000s. It is well short of the 1.5 per cent annual growth rate upon which government projections in the intergenerational report are predicated.

A range of explanations have been offered, including reduced economic dynamism evident in lower rates of business creation and destruction, and workers switching jobs to more productive firms, as well as lacklustre business investment, particularly in IT and research and development (R&D), and weaker competition.5 The pandemic has further highlighted the importance of highly productive firms with strong technological capabilities, as these firms have been most resilient and increased employment more during the pandemic.6

Australia needs a broad suite of measures that support improved dynamism in the economy and assist in lifting labour productivity back to historical averages. This includes actions that facilitate greater mobility of workers, such as more seamless occupational licensing requirements and abolishing stamp duties on residential property purchases in favour of land tax.

Governments also have an important role in supporting Australian businesses to leverage the benefits of technology, and ensuring that emerging technologies are designed, developed and used in the public interest. CEDA has previously proposed the appointment of a Chief Technologist to coordinate and overcome Australia’s piecemeal approach to tech policy and programs, as well as a technology assessment process to get regulation of new technologies right from the start.

The quality of Australia’s managers is critical to the dynamism and productivity of our businesses. CEDA is currently examining the dynamic capabilities of Australian companies, including recent performance and drivers. For policymakers, supporting the development of dynamic capabilities through pro-competitive regulation, open trade and investment may be one of the most practical and low-cost ways to lift innovation, productivity and prosperity.

Climate change

Australia’s choices on confronting climate change are becoming increasingly stark and urgent. The latest Intergovernmental Panel on Climate Change (IPCC) report showed that the path to 1.5°C will take place over the next 20 years, a decade earlier than previous projections.

This is driving significant momentum among businesses and investors to set more ambitious targets and invest in low emissions technologies. Given the accelerating path of global warming, Australian governments will need to play their part by setting more ambitious emissions reduction targets, and developing and implementing more detailed policies to facilitate the transition to net zero.

Facilitating massive new investments into the right areas, such as the electricity system, requires appropriate market signals, including those recommended by the Energy Security Board to transform the grid for the ‘electrification of everything’. Where market signals are not sufficient, governments must continue to enhance the role of bodies like the Clean Energy Finance Corporation to seed new technologies and innovation.

Recent modelling demonstrates the long-term economic benefits of taking more rapid action to address climate change, but as with any major structural change in the economy, climate change will have critical distributional consequences. Australia’s response will have highly concentrated long-term impacts on specific sectors, regions and workers, necessitating the need for targeted adjustment packages, including re-skilling.

Infrastructure

Australia’s infrastructure and construction sector has long been a productivity laggard. With major public infrastructure investment at historically high levels and still to peak in 2023, the current infrastructure boom should be used as an opportunity for governments to unlock greater productivity in infrastructure delivery.

As Infrastructure Australia suggests, this will require:

- Greater transparency and coordination of the project pipeline:

- More collaborative models of infrastructure delivery;

- Better utilisation of data and digital tools across the whole project life cycle; and

- Government investment in its own capability to be a more mature, model client.

Governments will also need to place increasing emphasis on the contribution of infrastructure to environmental and social sustainability. Infrastructure will need to be resilient to future climate events, while also contributing to reduced emissions and supporting consumers in reducing their emissions.

While infrastructure investment to date has been focused on economic infrastructure, significant government investments in social infrastructure across health, childcare, education, aged and disability care will be necessary to meet growing demand in these areas.

Effective infrastructure planning, design and delivery will ensure greater community and economic benefits from these projects. CEDA research by Associate Professor Elizabeth Hill in 20207 highlighted that investment in care industries has greater employment effects than investments in physical infrastructure and reduces gender inequality.

The government should adopt new anchors, including an appropriate benchmark for debt sustainability."

Skills shortages and the future workforce

During the pandemic, the focus of business and policymakers has very quickly shifted from saving jobs to addressing acute skills shortages.

CEDA’s recent survey of CFOs suggests that many industries’ investment and expansion plans are at risk of being held back by a lack of access to staff and talent, more so than any tax or regulatory impediments.

Some of these shortages may be short term, but many are not. We need to address shortages in our workforce that will be there for the long-term – particularly in caring roles such as aged and disability care. Governments must continue to support apprenticeship and training completions in areas of acute skills shortage, while also ensuring that childcare and other supports encourage participation from underrepresented groups – including women, older workers, young people and those with a disability.

Australia’s education and training system should be coordinating with the skilled migration system to address skills shortages across both short and long-time horizons. Keeping international borders open to skilled migrants and implementing the recommendations of the recent Joint Standing Committee inquiry into skilled migration would be good first steps to streamlining the path for skilled workers into the Australian economy. The inquiry supported more responsive and accurate mechanisms to identify skills shortages and new streamlined pathways such as intracompany transfers for trusted multinational companies. This would significantly contribute to alleviating skill shortages in critical areas such as technology.

Border closures and the lack of government support had an adverse impact on many temporary migrants in Australia who play an essential role in the economy. Providing greater certainty, including more timely processing, clearing of backlogs and facilitating the transition to permanent residency for those eligible, will improve Australia’s overall attractiveness to skilled migrants as more countries open their borders and seek to attract the best and brightest.

It is apparent that making inroads to reduce rates of poverty will not be possible without higher rates of income support, which are currently well below the poverty line.

Disadvantage

Evidence shows the pandemic has further exacerbated the financial, employment and health hardships of Australia’s most vulnerable and disadvantaged. But it also showed the power of good policy interventions.

Additional income support through JobKeeper payments and the JobSeeker Coronavirus Supplement temporarily lifted many out of poverty and helped others avoid it. The long-term picture is bleaker, with Australia underperforming on poverty reduction. As part of the UN Sustainable Development Goals, in 2015 Australia committed to at least halve the proportion of men, women and children of all ages living in poverty.

Six years on, Australia has made no discernible progress against this goal. If current trends in child poverty are repeated for children expected to be born over the next decade, a further 280,000 to 550,000 young Australians will encounter child poverty in the future.

This outcome is not inevitable – we could and should choose to fundamentally change the way we support people in disadvantage and act earlier to prevent disadvantage from becoming entrenched across generations. To do this, governments must develop and implement a new national agreement to reduce disadvantage and poverty, focusing on the development and use of integrated data as a circuit breaker for early intervention.

At the same time, it is apparent that making inroads to reduce rates of poverty will not be possible without higher rates of income support, which are currently well below the poverty line. By keeping Jobseeker and other income support payments at inadequate levels, we are making a choice for many Australians to live in poverty.

Conclusion

2022 has commenced in much the same uncertain and volatile fashion as recent years, dominated by natural disasters and the pandemic.

But short-term uncertainty must not lead to timidity by policymakers to confront the choices that Australia must now make to tackle the looming challenges and structural weaknesses of our economy.

These choices have been deferred for too long already. Capitalising on the opportunity to address these issues and sustainably improve the prospects of all Australians for decades to come demands greater policy ambition now.

Photos by National Cancer Institute; Ricardo Gomez Angel; American Public Power Association and william william on Unsplash.

Footnotes: Download EPO 2022 PDF for footnotes

ECONOMIC AND POLITICAL OUTLOOK 2022

Read more chapters like this in CEDA's EPO 2022.